Pizza Hut 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

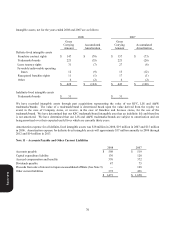

70

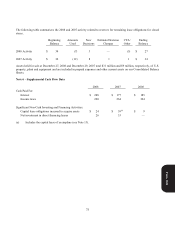

Increase (Decrease)

Company sales $ 299

Company restaurant expenses 237

Franchise and license fees (19)

General and administrative expenses 6

Other (income) expense (30)

Operating Profit 7

The impact on Other (income) expense includes both the current year minority interest in pre-tax earnings of the

unconsolidated affiliate as well as the reduction in Other (income) expense that resulted from our share of after-tax

earnings no longer being reported in Other (income) expense. The increase in Operating Profit was offset by a

corresponding increase in Income tax provision such that there was no impact to Net Income. Our Consolidated Balance

Sheet at December 27, 2008 reflects the consolidation of this entity; with Investment in unconsolidated affiliates

eliminated, the entity’s balance sheet consolidated and a minority interest reflected in Other liabilities and deferred

credits.

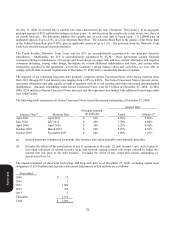

Sale of Our Interest in Our Japan Unconsolidated Affiliate

In December 2007, we sold our interest in our unconsolidated affiliate in Japan for $128 million in cash (including the

impact of related foreign currency contracts that were settled in December 2007). Our international subsidiary that owned

this interest operates on a fiscal calendar with a period end that is approximately one month earlier than our consolidated

period close. Thus, consistent with our historical treatment of events occurring during the lag period, the pre-tax gain on

the sale of this investment of $100 million was recorded in the quarter ended March 22, 2008. However, the cash

proceeds from this transaction were transferred from our international subsidiary to the U.S. in December 2007 and thus

were reported on our Consolidated Statement of Cash Flows for the year ended December 29, 2007. The offset to this

cash on our Consolidated Balance Sheet at December 29, 2007 was in accounts payable and other current liabilities,

which was relieved in the quarter ended March 22, 2008 upon recognition of the gain.

While we will no longer have an ownership interest in the entity that operates both KFCs and Pizza Huts in Japan, it will

continue to be a franchisee as it was when it operated as an unconsolidated affiliate. Excluding the one-time gain, the sale

of our interest in our Japan unconsolidated affiliate did not have a significant impact on our results of operations for the

year ended December 27, 2008 as the Other income we previously recorded representing our share of earnings of the

unconsolidated affiliate has historically not been significant.

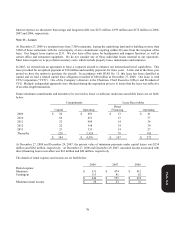

U.S. Business Transformation

As part of our plan to transform our U.S. business we took several measures (“the U.S. business transformation

measures”) in 2008. These measures included: expansion of our U.S. refranchising; charges relating to G&A productivity

initiatives and realignment of resources (primarily severance and early retirement costs); and investments in our U.S.

Brands made on behalf of our franchisees such as equipment purchases.

In the year ended December 27, 2008, we refranchised 700 restaurants in the U.S. resulting in a pre-tax loss of $5 million.

These refranchising losses were the net result of our refranchising of, or offers to refranchise, stores or groups of stores in

the U.S. at prices less than their recorded carrying values.

We provided severance and early retirement benefits to certain U.S. based employees as part of our G&A productivity

initiatives and realignment of resources. In connection with this we recorded a pre-tax charge of $49 million during 2008

including $18 million from the resulting impact on our pension and post retirement medical plans. The current liability

for the severance portion of this charge was $27 million as of December 27, 2008.

Form 10-K