Pizza Hut 2008 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

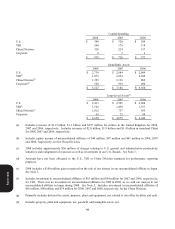

Foreign operating and capital loss carryforwards totaling $687 million and state operating loss carryforwards totaling $1.2

billion at year end 2008 are being carried forward in jurisdictions where we are permitted to use tax losses from prior

periods to reduce future taxable income. These losses will expire as follows: $19 million in 2009, $126 million between

2010 and 2013, $1.2 billion between 2014 and 2028 and $554 million may be carried forward indefinitely. In addition,

tax credits totaling $21 million are available to reduce certain federal and state liabilities, of which $13 million will expire

between 2014 and 2028 and $8 million may be carried forward indefinitely.

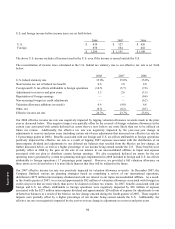

Effective December 31, 2006, we adopted FIN 48 which requires that a position taken or expected to be taken in a tax

return be recognized in the financial statements when it is more likely than not (i.e. a likelihood of more than fifty percent)

that the position would be sustained upon examination by tax authorities. A recognized tax position is then measured at

the largest amount of benefit that is greater than fifty percent likely of being realized upon settlement.

At year end 2008, we decreased our 2007 beginning and ending amounts of unrecognized tax benefits to $294 million and

$343 million, respectively. This resulted from netting, where appropriate, certain long-term Deferred income tax assets

against unrecognized tax benefits included as part of Other liabilities and deferred credits recorded on our Consolidated

Balance Sheet at December 29, 2007. The Company had $296 million of unrecognized tax benefits at December 27,

2008, $225 million of which, if recognized, would affect the effective income tax rate. A reconciliation of the beginning

and ending amount of unrecognized tax benefits follows:

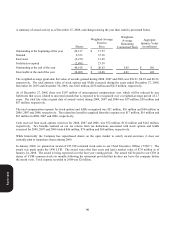

2008 2007

Beginning of Year $ 343 $294

Additions on tax

p

ositions related to the current

y

ea

r

53 105

Additions for tax

p

ositions of

p

rior

y

ears 21 17

Reductions for tax

p

ositions of

p

rior

y

ears

(

110

)

(

58

)

Reductions for settlements

(

2

)

(

6

)

Reductions due to statute ex

p

iration

(

7

)

(

11

)

Forei

g

n currenc

y

translation ad

j

ustmen

t

(

2

)

2

End of Year $ 296 $343

The major jurisdictions in which the Company files income tax returns include the U.S. federal jurisdiction, China, the

United Kingdom, Mexico and Australia. As of December 27, 2008, the earliest years that the Company was subject to

examination in these jurisdictions were 1999 in the U.S., 2005 in China, 2000 in the United Kingdom, 2001 in Mexico

and 2004 in Australia. In addition, the Company is subject to various U.S. state income tax examinations, for which, in

the aggregate, we had significant unrecognized tax benefits at December 27, 2008. The Company believes that it is

reasonably possible that its unrecognized tax benefits may decrease by approximately $60 million in the next 12 months,

including approximately $18 million, which if recognized upon audit settlement or statute expiration, will affect the 2009

effective tax rate. The remaining decrease in unrecognized tax benefits relate to various positions, each of which are

individually insignificant.

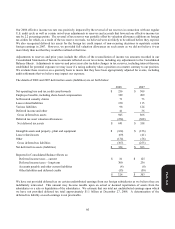

At December 27, 2008, long-term liabilities of $229 million, including $32 million for the payment of accrued interest and

penalties, are included in Other liabilities and deferred credits as reported on the Consolidated Balance Sheet. Total

accrued interest and penalties recorded at December 27, 2008 were $49 million. During 2008, accrued interest and

penalties decreased by $9 million, of which $7 million affected the 2008 effective tax rate. At December 29, 2007, long-

term liabilities of $265 million, including $51 million for the payment of accrued interest and penalties, are included in

Other liabilities and deferred credits as reported on the Consolidated Balance Sheet. Total accrued interest and penalties

recorded at December 29, 2007 were $58 million. During 2007, accrued interest and penalties decreased by $16 million,

of which $11 million affected the 2007 effective tax rate. The Company recognizes accrued interest and penalties related

to unrecognized tax benefits as components of its income tax provision.

Form 10-K