Pizza Hut 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

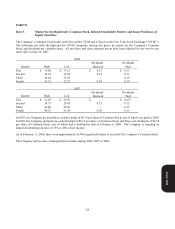

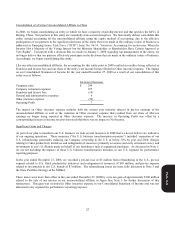

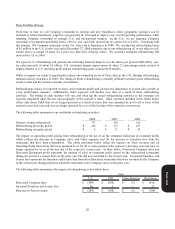

Consolidation of a Former Unconsolidated Affiliate in China

In 2008, we began consolidating an entity in which we have a majority ownership interest and that operates the KFCs in

Beijing, China. Our partners in this entity are essentially state-owned enterprises. We historically did not consolidate this

entity, instead accounting for the unconsolidated affiliate using the equity method of accounting, due to the effective

participation of our partners in the significant decisions of the entity that were made in the ordinary course of business as

addressed in Emerging Issues Task Force ("EITF") Issue No. 96-16, "Investor's Accounting for an Investee When the

Investor Has a Majority of the Voting Interest but the Minority Shareholder or Shareholders Have Certain Approval or

Veto Rights". Concurrent with a decision that we made on January 1, 2008 regarding top management of the entity, we

no longer believe that our partners effectively participate in the decisions that are made in the ordinary course of business.

Accordingly, we began consolidating this entity.

Like our other unconsolidated affiliates, the accounting for this entity prior to 2008 resulted in royalties being reflected as

Franchise and license fees and our share of the entity’s net income being reflected in Other (income) expense. The impact

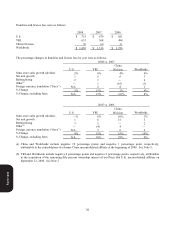

on our Consolidated Statement of Income for the year ended December 27, 2008 as a result of our consolidation of this

entity was as follows:

Increase (Decrease)

Company sales $ 299

Company restaurant expenses 237

Franchise and license fees (19)

General and administrative expenses 6

Other (income) expense (30)

Operating Profit 7

The impact on Other (income) expense includes both the current year minority interest in pre-tax earnings of the

unconsolidated affiliate as well as the reduction in Other (income) expense that resulted from our share of after-tax

earnings no longer being reported in Other (income) expense. The increase in Operating Profit was offset by a

corresponding increase in Income tax provision such that there was no impact to Net Income.

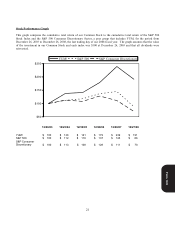

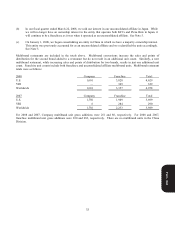

Significant Gains and Charges

As part of our plan to transform our U.S. business we took several measures in 2008 that we do not believe are indicative

of our ongoing operations. These measures (“the U.S. business transformation measures”) included: expansion of our

U.S. refranchising, potentially reducing our Company ownership in the U.S. to below 10% by year end 2010; charges

relating to G&A productivity initiatives and realignment of resources (primarily severance and early retirement costs); and

investments in our U.S. Brands made on behalf of our franchisees such as equipment purchases. As discussed in Note 5,

we are not including the impacts of these U.S. business transformation measures in our U.S. segment for performance

reporting purposes.

In the year ended December 27, 2008, we recorded a pre-tax loss of $5 million from refranchising in the U.S., pre-tax

expense related to U.S. G&A productivity initiatives and realignment of resources of $49 million, and pre-tax expense

related to investments in our U.S. brands of $7 million. The refranchising losses are more fully discussed in Note 5 and

the Store Portfolio Strategy of the MD&A.

These losses were more than offset in the year ended December 27, 2008 by a pre-tax gain of approximately $100 million

related to the sale of our interest in our unconsolidated affiliate in Japan (See Note 5 for further discussion of this

transaction). This gain was recorded in Other (income) expense in our Consolidated Statement of Income and was not

allocated to any segment for performance reporting purposes.

Form 10-K