Pizza Hut 2008 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

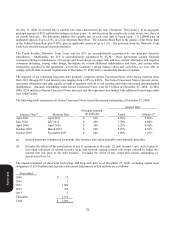

Note 3 – Two-for-One Common Stock Split

On May 17, 2007, the Company announced that its Board of Directors approved a two-for-one split of the Company’s

outstanding shares of Common Stock. The stock split was effected in the form of a stock dividend and entitled each

shareholder of record at the close of business on June 1, 2007 to receive one additional share for every outstanding share

of Common Stock held. The stock dividend was distributed on June 26, 2007, with approximately 261 million shares of

Common Stock distributed. All per share and share amounts in the accompanying Financial Statements and Notes to the

Financial Statements have been adjusted to reflect the stock split.

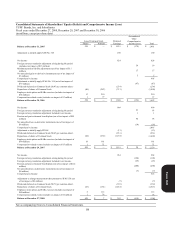

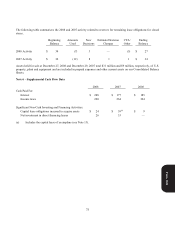

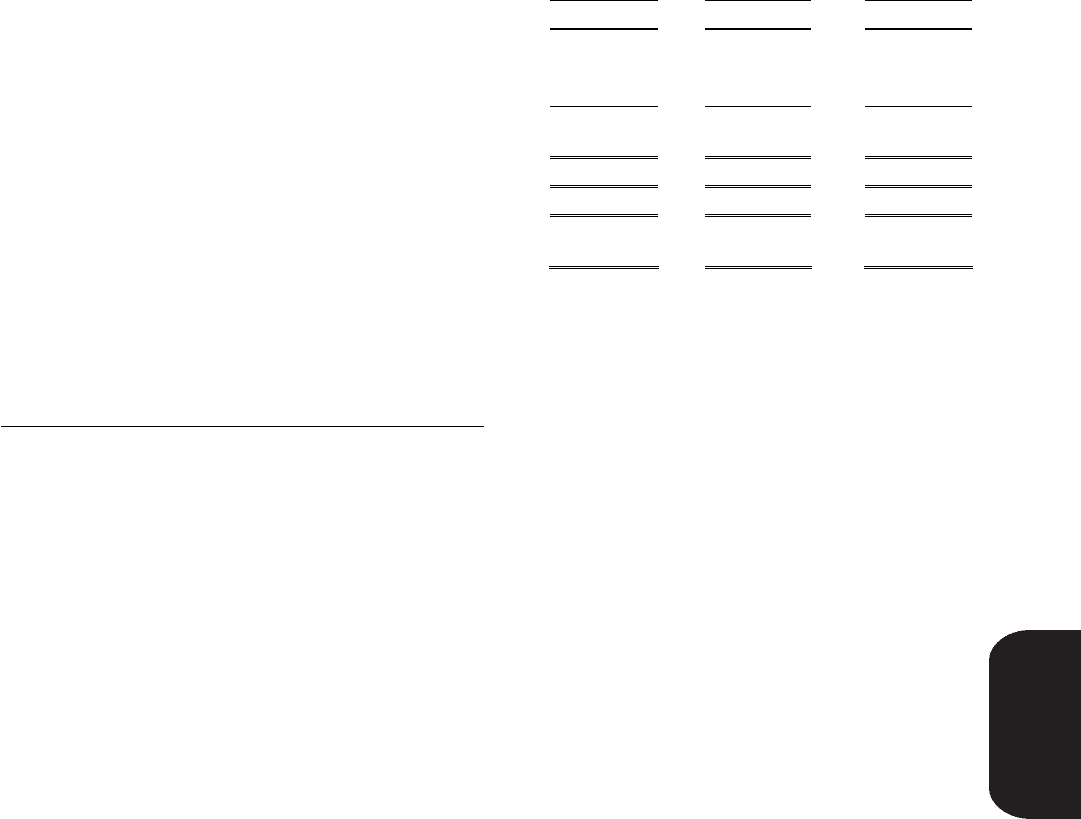

Note 4 – Earnings Per Common Share (“EPS”)

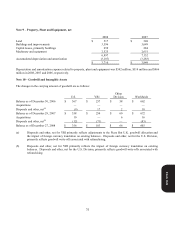

2008 2007 2006

Net income $ 964 $ 909 $ 824

Weighted-average common shares outstanding (for basic

calculation) 475 522 546

Effect of dilutive share-based employee compensation 16 19 18

Weighted-average common and dilutive potential common shares

outstanding (for diluted calculation) 491 541 564

Basic EPS $ 2.03 $ 1.74 $ 1.51

Diluted EPS $ 1.96 $ 1.68 $ 1.46

Unexercised employee stock options and stock appreciation rights

(in millions) excluded from the diluted EPS compensation(a) 5.9 5.7 13.3

(a) These unexercised employee stock options and stock appreciation rights were not included in the computation of

diluted EPS because to do so would have been antidilutive for the periods presented.

Note 5 – Items Affecting Comparability of Net Income and Cash Flows

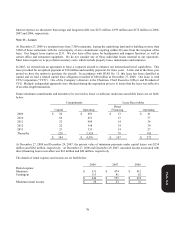

Consolidation of a Former Unconsolidated Affiliate in China

In 2008, we began consolidating an entity in which we have a majority ownership interest and that operates the KFCs in

Beijing, China. Our partners in this entity are essentially state-owned enterprises. We historically did not consolidate this

entity, instead accounting for the unconsolidated affiliate using the equity method of accounting, due to the effective

participation of our partners in the significant decisions of the entity that were made in the ordinary course of business as

addressed in Emerging Issues Task Force ("EITF") Issue No. 96-16, "Investor's Accounting for an Investee When the

Investor Has a Majority of the Voting Interest but the Minority Shareholder or Shareholders Have Certain Approval or

Veto Rights". Concurrent with a decision that we made on January 1, 2008 regarding top management of the entity, we

no longer believe that our partners effectively participate in the decisions that are made in the ordinary course of business.

Accordingly, we began consolidating this entity.

Like our other unconsolidated affiliates, the accounting for this entity prior to 2008 resulted in royalties being reflected as

Franchise and license fees and our share of the entity’s net income being reflected in Other (income) expense. The impact

on our Consolidated Statement of Income for the year ended December 27, 2008 as a result of our consolidation of this

entity was as follows:

Form 10-K