Pizza Hut 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

23MAR200920295069

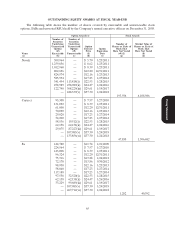

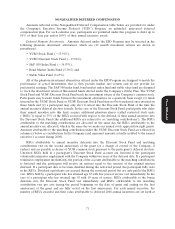

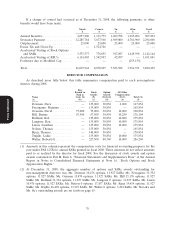

OPTION EXERCISES AND STOCK VESTED

The table below shows the number of shares of YUM common stock acquired during 2008 upon

exercise of stock options and vesting of stock awards in the form of RSUs, each before payment of

applicable withholding taxes and broker commissions.

Option Awards Stock Awards

Number of Shares Value Realized Number of Shares Value realized

Acquired on Exercise on Exercise Acquired on Vesting on Vesting

Name (#) ($) (#)(1) ($)

(a) (b) (c) (d) (e)

Novak — — 165,396 5,735,718

Carucci 109,616 3,387,273 6,839 243,810

Su — — 60,268 2,090,007

Allan 84,404 2,345,798 31,036 1,106,433

Creed 23,411 601,232 28,460 1,014,599

(1) These amounts represent RSUs that became vested in 2008. These shares will be distributed in

accordance with the deferral election made by the named executive officer under the EID Program.

See page 71 for a discussion of the EID Program.

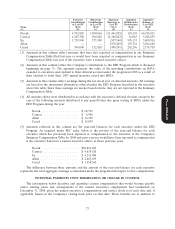

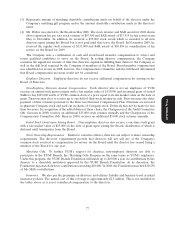

PENSION BENEFITS

The table below shows the present value of accumulated benefits payable to each of the named

executive officers, including the number of years of service credited to each such named executive officer,

under the YUM! Brands Retirement Plan (‘‘Retirement Plan’’) and the YUM! Brands, Inc. Pension

Equalization Plan (‘‘Pension Equalization Plan’’) or the YUM! Brands International Retirement Plan

determined using interest rate and mortality rate assumptions consistent with those used in the Company’s

financial statements.

Number of Present Value of Payments

Years of Accumulated During

Proxy Statement

Credited Service Benefit(4) Last Fiscal Year

Name Plan Name (#) ($) ($)

(a) (b) (c) (d) (e)

Novak Retirement Plan(1) 22 701,145 —

Pension Equalization Plan(2) 22 13,820,312 —

Carucci Retirement Plan(1) 24 430,022 —

Pension Equalization Plan(2) 24 2,234,001 —

Su International Retirement

Plan(3) 19 4,679,537 —

Allan Retirement Plan(1) 5* 158,962 —

Pension Equalization Plan(2) 5* 930,916 —

Creed Retirement Plan(1) 2* 53,793 —

Pension Equalization Plan(2) 2* 0 —

* Under these plans, Messrs. Allan and Creed only receive credited service for their eligible U.S. based

service. Mr. Allan was based outside the U.S. for 11 years. Mr. Creed was based outside the U.S. for

7 years. During that time neither accrued a benefit under any retirement plan based upon final

compensation or years of service like these plans. In addition, under the terms of Mr. Creed’s

assignment in the U.S., he is covered under an Australian defined contribution plan related to his

service in Australia prior to his transfer to the U.S. to which the Company continues to make annual

contributions. While the Company makes contributions to the Australian plan, Mr. Creed will not

67