Pizza Hut 2008 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

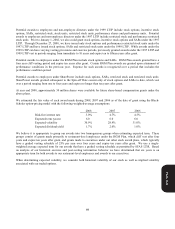

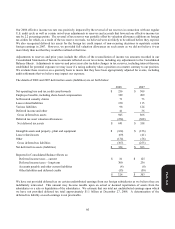

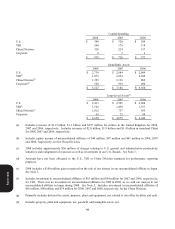

(i) Includes long-lived assets of $602 million, $843 million and $813 million for entities in the United Kingdom for

2008, 2007 and 2006, respectively. The 2008 decrease in long-lived assets was driven by the impact of foreign

currency. Includes long-lived assets of $905 million, $651 million and $495 million in mainland China for 2008,

2007 and 2006, respectively.

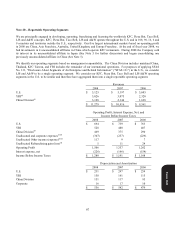

See Note 5 for additional operating segment disclosures related to impairment, store closure (income) costs and the

carrying amount of assets held for sale.

Note 21 – Contingencies

Insurance Programs

We are self-insured for a substantial portion of our current and prior years’ coverage including workers’ compensation,

employment practices liability, general liability, automobile liability, product liability and property losses (collectively,

“property and casualty losses”). To mitigate the cost of our exposures for certain property and casualty losses, we make

annual decisions to self-insure the risks of loss up to defined maximum per occurrence retentions on a line by line basis or

to combine certain lines of coverage into one loss pool with a single self-insured aggregate retention. The Company then

purchases insurance coverage, up to a certain limit, for losses that exceed the self-insurance per occurrence or aggregate

retention. The insurers’ maximum aggregate loss limits are significantly above our actuarially determined probable

losses; therefore, we believe the likelihood of losses exceeding the insurers’ maximum aggregate loss limits is remote.

In the U.S. and in certain other countries, we are also self-insured for healthcare claims and long-term disability for

eligible participating employees subject to certain deductibles and limitations. We have accounted for our retained

liabilities for property and casualty losses, healthcare and long-term disability claims, including reported and incurred but

not reported claims, based on information provided by independent actuaries.

Due to the inherent volatility of actuarially determined property and casualty loss estimates, it is reasonably possible that

we could experience changes in estimated losses which could be material to our growth in quarterly and annual net

income. We believe that we have recorded reserves for property and casualty losses at a level which has substantially

mitigated the potential negative impact of adverse developments and/or volatility.

Legal Proceedings

We are subject to various claims and contingencies related to lawsuits, real estate, environmental and other matters arising

in the normal course of business. We provide reserves for such claims and contingencies when payment is probable and

estimable in accordance with SFAS No. 5, “Accounting for Contingencies.”

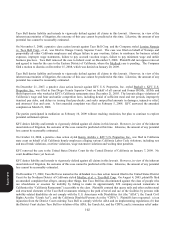

On November 26, 2001, Kevin Johnson, a former LJS restaurant manager, filed a collective action against LJS in the

United States District Court for the Middle District of Tennessee alleging violation of the Fair Labor Standards Act

(“FLSA”) on behalf of himself and allegedly similarly-situated LJS general and assistant restaurant managers. Johnson

alleged that LJS violated the FLSA by perpetrating a policy and practice of seeking monetary restitution from LJS

employees, including Restaurant General Managers (“RGMs”) and Assistant Restaurant General Managers (“ARGMs”),

when monetary or property losses occurred due to knowing and willful violations of LJS policies that resulted in losses of

company funds or property, and that LJS had thus improperly classified its RGMs and ARGMs as exempt from overtime pay

under the FLSA. Johnson sought overtime pay, liquidated damages, and attorneys’ fees for himself and his proposed class.

LJS moved the Tennessee district court to compel arbitration of Johnson’s suit. The district court granted LJS’s motion

on June 7, 2004, and the United States Court of Appeals for the Sixth Circuit affirmed on July 5, 2005.

On December 19, 2003, while the arbitrability of Johnson’s claims was being litigated, former LJS managers Erin Cole

and Nick Kaufman, represented by Johnson’s counsel, initiated an arbitration with the American Arbitration Association

(“AAA”) (the “Cole Arbitration”). The Cole Claimants sought a collective arbitration on behalf of the same putative class

as alleged in the Johnson lawsuit and alleged the same underlying claims.

Form 10-K