Pizza Hut 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23MAR200920294881

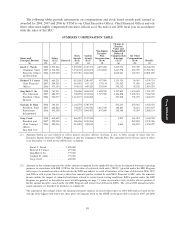

In setting compensation for 2008, the Committee considered the historical performance of the

Company since its inception, noting that Mr. Novak had been President for each of those years, CEO since

2000 and Chairman since 2001. The Committee noted that for the prior nine, five and one year periods,

the Company had on average performed very strongly versus the nondurable consumer products peer

group in terms of total shareholder return (top quartile), return on net assets (top quartile), earnings per

share growth (top 50%) and operating income growth (top 50%). Based on this sustained strong

performance, the Committee determined that Mr. Novak’s target total compensation for 2008 should be

set near or at the 75th percentile as compared to the compensation of chief executives in the peer group.

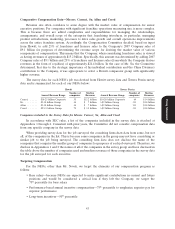

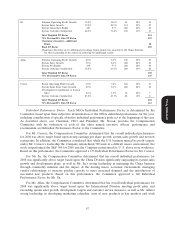

Based on this analysis, the Committee approved the following compensation for 2008:

Salary $1,400,000

Target Bonus Percentage 150%

Grant Date Economic Value of 2008 LTI Award:

Stock Appreciation Rights $4,160,000

RSUs—Deferral of Bonus $1,580,964

RSUs—Retention Award $7,000,000

After the adjustments described below, the Committee noted that the total target compensation for

Mr. Novak was at the 72nd percentile of the CEO peer group.

The Compensation Committee approved a 2008 salary increase for Mr. Novak of 6% effective

January 29, 2008, adjusting his base salary to $1,400,000. The Committee also approved a ten percentage

point increase in his target bonus percentage. The Compensation Committee approved these salary and

target bonus percentage increases based on its desire to compensate him near the 75th percentile for total

compensation and their subjective assessment of Mr. Novak’s demonstrated strong and effective

performance in 2007. The Committee structured this compensation in line with Yum’s pay for performance

Proxy Statement

philosophy of rewarding performance by increasing his target bonus percentage and making more of the

additional compensation at risk.

In January 2008, the Committee approved the grant date value of the long-term incentive award

having a value of $5.74 million. This award was comprised of SARs with a value of $4.16 million, and

restricted stock units under the deferral plan with a value of $1.58 million. This award reflected the

Compensation Committee’s subjective determination that, based on his strong performance in 2007 and

the sustained performance of the Company (without assigning any weight to any particular item), he

should receive a long-term incentive award consistent with their desire to compensate Mr. Novak at the

75th percentile for total compensation. In making this determination, the Committee noted that Mr. Novak

elected to defer 100% of his 2007 annual incentive payment, which was otherwise payable in the first

quarter of 2008. As a result of this deferral, Mr. Novak received a matching contribution of phantom

shares (referred to as RSUs) equal in value to 33% of the number of RSUs he received upon deferral of

his bonus. The portion of the deferral attributable to the matching contribution, $1.58 million, was

considered by the Compensation Committee in the assessment of Mr. Novak’s long-term incentive

compensation versus the market and in the determination of his SARs award for 2008. Specifically (as

noted above), the Committee determined that the value of Mr. Novak’s total long-term incentive award

should be $5.74 million. After taking into consideration the matching contributions attributable to the

deferral of his 2007 annual incentive payment, this resulted in awarding a SARs award with a value of

$4.16 million ($5.74 million less $1.58 million).

At the conclusion of 2008, the Committee determined Mr. Novak earned an annual incentive award

payment for 2008 performance of $4,057,200. For 2008, the Compensation Committee established

50