Pizza Hut 2008 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

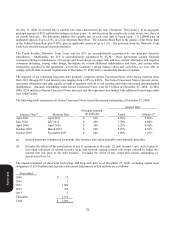

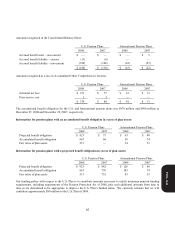

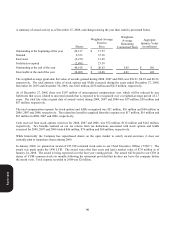

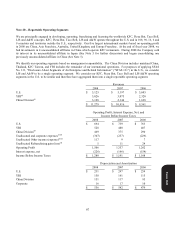

Benefit Payments

The benefits expected to be paid in each of the next five years and in the aggregate for the five years thereafter are set

forth below:

Year ended:

U.S.

Pension Plans

International

Pension Plans

2009 $ 65 $ 1

2010 50 1

2011 34 2

2012 37 2

2013 43 2

2014 - 2018 243 7

Expected benefits are estimated based on the same assumptions used to measure our benefit obligation on the

measurement date and include benefits attributable to estimated further employee service.

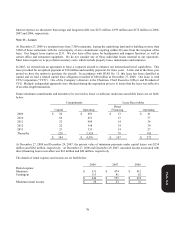

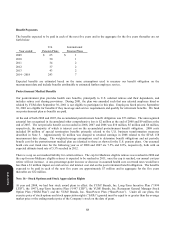

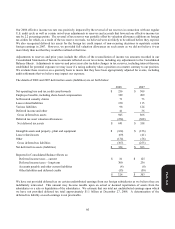

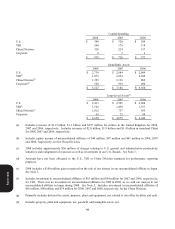

Postretirement Medical Benefits

Our postretirement plan provides health care benefits, principally to U.S. salaried retirees and their dependents, and

includes retiree cost sharing provisions. During 2001, the plan was amended such that any salaried employee hired or

rehired by YUM after September 30, 2001 is not eligible to participate in this plan. Employees hired prior to September

30, 2001 are eligible for benefits if they meet age and service requirements and qualify for retirement benefits. We fund

our postretirement plan as benefits are paid.

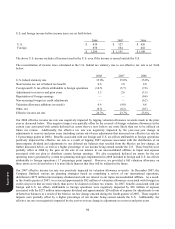

At the end of both 2008 and 2007, the accumulated postretirement benefit obligation was $73 million. The unrecognized

actuarial loss recognized in Accumulated other comprehensive loss is $2 million at the end of 2008 and $9 million at the

end of 2007. The net periodic benefit cost recorded in 2008, 2007 and 2006 was $10 million, $5 million and $6 million,

respectively, the majority of which is interest cost on the accumulated postretirement benefit obligation. 2008 costs

included $4 million of special termination benefits primarily related to the U.S. business transformation measures

described in Note 5. Approximately $2 million was charged to retained earnings in 2008 related to the SFAS 158

measurement date change. The weighted-average assumptions used to determine benefit obligations and net periodic

benefit cost for the postretirement medical plan are identical to those as shown for the U.S. pension plans. Our assumed

heath care cost trend rates for the following year as of 2008 and 2007 are 7.5% and 8.0%, respectively, both with an

expected ultimate trend rate of 5.5% reached in 2012.

There is a cap on our medical liability for certain retirees. The cap for Medicare eligible retirees was reached in 2000 and

the cap for non-Medicare eligible retirees is expected to be reached in 2011; once the cap is reached, our annual cost per

retiree will not increase. A one-percentage-point increase or decrease in assumed health care cost trend rates would have

less than a $1 million impact on total service and interest cost and on the post retirement benefit obligation. The benefits

expected to be paid in each of the next five years are approximately $7 million and in aggregate for the five years

thereafter are $32 million.

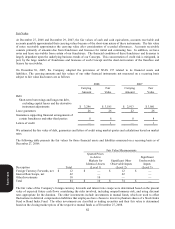

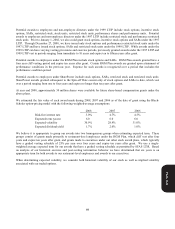

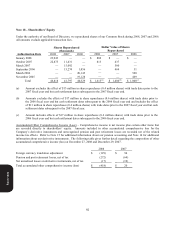

Note 16 – Stock Options and Stock Appreciation Rights

At year end 2008, we had four stock award plans in effect: the YUM! Brands, Inc. Long-Term Incentive Plan (“1999

LTIP”), the 1997 Long-Term Incentive Plan (“1997 LTIP”), the YUM! Brands, Inc. Restaurant General Manager Stock

Option Plan (“RGM Plan”) and the YUM! Brands, Inc. SharePower Plan (“SharePower”). Under all our plans, the

exercise price of stock options and stock appreciation rights (“SARs”) granted must be equal to or greater than the average

market price or the ending market price of the Company’s stock on the date of grant.

Form 10-K