Pizza Hut 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23MAR200920295069

communication or understanding. This is especially true in the event of a ‘‘no’’ vote on compensation since

the vote alone will not provide any insight into what specific items shareholders are voting against (or why

they voted against it). We believe that our current process of direct engagement already allows an avenue

for discussion of specific concerns regarding compensation. A retrospective advisory vote would not

improve or significantly alter that process of direct engagement.

Our Compensation Committee, which is comprised entirely of independent, non-employee directors,

is responsible for designing and administering our executive compensation program. Decisions on how best

to carry out these responsibilities are influenced by economic and industry conditions, current and future

strategic goals, accounting requirements and tax laws, evolving governance trends, as well as the practices

of our peers and competitors. Reducing a series of complicated decisions by independent directors who are

intimately familiar with all relevant factors to a single, after-the-fact, ‘‘yes’’ or ‘‘no’’ advisory vote is not an

effective or efficient method to obtain shareholder input.

As further discussed in our ‘‘Compensation Discussion and Analysis,’’ our Compensation Committee’s

goal is to use our compensation program to attract, reward and retain the talented leaders necessary to

enable our Company to succeed in the highly competitive market for talent, while maximizing shareholder

returns. Our management team, which has been attracted, rewarded and retained through our

compensation program, has been a key driver in YUM’s strong performance over both the short and long-

term. For example, as shown in the table below, YUM’s investor total return compares favorably against

the S&P 500 Index, a group of nondurable consumer products companies that are used in setting

benchmarks for our CEO’s compensation (as further described on page 49), as well as a select group of

global growth companies including Colgate-Palmolive Company, Kellogg Company, McDonald’s

Corporation, PepsiCo, Inc., Starbucks Corporation, The Coca-Cola Company and The Procter & Gamble

Company, over one, five and ten years.

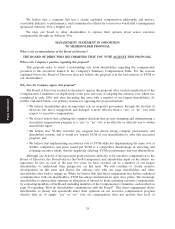

Investor Total Return(1) Comparison (as of 12/31/08)

1 Year 5 Year 10 Year

YUM! Brands, Inc. .............................. ǁ16% 14% 10%

Proxy Statement

S&P 500 Index .................................. ǁ37% ǁ2% ǁ1%

Nondurable Consumer Products Group(2) ............... ǁ28% ǁ3% 1%

Global Consumer Group(3) ......................... ǁ19% 5% 4%

(1) Compound annual growth rate of stock price adjusted for stock splits and dividends. For the

‘‘Nondurable Consumer Products Group’’ and ‘‘Global Consumer Group,’’ the total investor return

was calculated by taking the average of the total investor returns for all of the individual companies

included in the respective group.

(2) Includes only the publicly-traded companies included in the nondurable consumer products group

discussed on page 49. The group includes AutoNation, Inc., AutoZone, Inc., Avon Products, Inc.,

Blockbuster Inc., The Coca-Cola Company, Colgate-Palmolive Company, CVS Caremark

Corporation, Darden Restaurants, Inc., The Gap, Inc., General Mills, Inc., J.C. Penney

Company, Inc., Kellogg Company, Kimberly-Clark Corporation, Kohl’s Corporation, Limited Brands,

Lowe’s Companies, Inc., Macy’s, Inc., Marriott International, Inc., McDonald’s Corporation, Office

Depot, OfficeMax Incorporated, PepsiCo, Inc., Staples, Inc. and Walgreen Co.

(3) Includes Colgate-Palmolive Company, Kellogg Company, McDonald’s Corporation, PepsiCo, Inc.,

Starbucks Corporation, The Coca-Cola Company and The Procter & Gamble Company.

In other words, we believe our compensation program has played an important role in driving strong

shareholder returns. We do not believe it would benefit YUM or our shareholders to alter this successful

25