Pizza Hut 2008 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

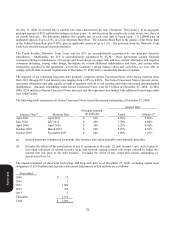

Lease Accounting by our Pizza Hut United Kingdom Unconsolidated Affiliate Prior to our fourth quarter 2006

acquisition of the remaining fifty percent interest in our Pizza Hut U.K. unconsolidated affiliate, we accounted for our

ownership under the equity method. The unconsolidated affiliate historically accounted for all of its leases as operating

and we made no adjustments in recording equity income. We decreased our 2006 beginning retained earnings balance by

approximately $4 million to reflect our fifty percent share of the cumulative equity income impact of properly recording

certain leases as capital.

Recognition of Certain State Tax Benefits We historically recognized certain state tax benefits on a cash basis as they

were recognized on the respective state tax returns instead of in the year the benefit originated. We increased our 2006

beginning retained earnings by approximately $7 million to recognize these state tax benefits as deferred tax assets.

New Accounting Pronouncements Not Yet Adopted.

In February 2008, the FASB issued FASB Staff Position (“FSP”) No. 157-2, “Effective Date of FASB Statement No.

157” which permits a one-year deferral for the implementation of SFAS 157 with regard to non-financial assets and

liabilities that are not recognized or disclosed at fair value in the financial statements on a recurring basis (at least

annually). We elected to defer adoption of SFAS 157 for such non-financial assets and liabilities, which, for the

Company, primarily includes long-lived assets, goodwill and intangibles for which fair value would be determined as part

of related impairment tests, and we do not currently anticipate that full adoption in 2009 will materially impact the

Company’s results of operations or financial condition.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS 141R”). SFAS

141R, which is broader in scope than SFAS 141, applies to all transactions or other events in which an entity obtains

control of one or more businesses, and requires that the acquisition method be used for such transactions or events. SFAS

141R, with limited exceptions, will require an acquirer to recognize the assets acquired, the liabilities assumed, and any

noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date. This will result

in acquisition related costs and anticipated restructuring costs related to the acquisition being recognized separately from

the business combination. SFAS 141R is effective as of the beginning of an entity’s first fiscal year beginning after

December 15, 2008, the year beginning December 28, 2008 for the Company. The impact of SFAS 141R on the

Company will be dependent upon the extent to which we have transactions or events occur that are within its scope.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements”

(“SFAS 160”). SFAS 160 amends Accounting Research Bulletin No. 51, “Consolidated Financial Statements,” and will

change the accounting and reporting for noncontrolling interests, which are the portion of equity in a subsidiary not

attributable, directly or indirectly, to a parent. SFAS 160 is effective for fiscal years and interim periods beginning on or

after December 15, 2008, the year beginning December 28, 2008 for the Company and requires retroactive adoption of its

presentation and disclosure requirements. We do not anticipate that the adoption of SFAS 160 will materially impact the

Company.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities”

(“SFAS 161”). SFAS 161 amends and expands the disclosure requirements in SFAS 133, “Accounting for Derivative

Instruments and Hedging Activities”. SFAS 161 is effective for fiscal years and interim periods beginning after

November 15, 2008, the year beginning December 28, 2008 for the Company.

In December 2008, the FASB issued FSP No. FAS 132(R)-1 (“FSP FAS 132(R)-1”), “Employers’ Disclosures about

Postretirement Benefit Plan Assets,” which expands the disclosure requirements about plan assets for defined benefit

pension plans and postretirement plans. FSP FAS 132(R)-1 is effective for financial statements issued for fiscal years

ending after December 15, 2009, the year ending December 26, 2009 for the Company.

Form 10-K