Pizza Hut 2008 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

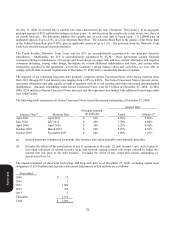

Note 14 – Financial Instruments

Derivative Instruments

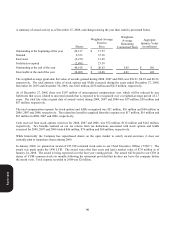

We enter into interest rate swaps with the objective of reducing our exposure to interest rate risk and lowering interest

expense for a portion of our debt. Under the contracts, we agree with other parties to exchange, at specified intervals, the

difference between variable rate and fixed rate amounts calculated on a notional principal amount. At December 27, 2008

and December 29, 2007, interest rate derivative instruments outstanding had notional amounts of $775 million and $850

million, respectively. These swaps have reset dates and floating rate indices which match those of our underlying fixed-

rate debt and have been designated as fair value hedges of a portion of that debt. As the swaps qualify for the short-cut

method under SFAS 133, no ineffectiveness has been recorded.

We enter into foreign currency forward contracts with the objective of reducing our exposure to cash flow volatility

arising from foreign currency fluctuations associated with certain foreign currency denominated intercompany short-term

receivables and payables. The notional amount, maturity date, and currency of these contracts match those of the

underlying receivables or payables. For those foreign currency exchange forward contracts that we have designated as

cash flow hedges, we measure ineffectiveness by comparing the cumulative change in the forward contract with the

cumulative change in the hedged item. No material ineffectiveness was recognized in 2008, 2007 or 2006 for those

foreign currency forward contracts designated as cash flow hedges.

As of December 27, 2008, we had a net deferred loss associated with cash flow hedges of approximately $17 million, net

of tax, due to treasury locks, forward starting interest rate swaps and foreign currency forward contracts. The majority of

this loss arose from the settlement of forward starting interest rate swaps entered into prior to the issuance of our Senior

Unsecured Notes due in 2037, and is being reclassified into earnings through 2037 to interest expense.

As a result of the use of derivative instruments, the Company is exposed to risk that the counterparties will fail to meet

their contractual obligations. Recent adverse developments in the global financial and credit markets could negatively

impact the creditworthiness of our counterparties and cause one or more of our counterparties to fail to perform as

expected. To mitigate the counterparty credit risk, we only enter into contracts with carefully selected major financial

institutions based upon their credit ratings and other factors, and continually assess the creditworthiness of counterparties.

At December 27, 2008, all of the counterparties to our interest rate swaps and foreign currency forwards had investment

grade ratings. To date, all couterparties have performed in accordance with their contractual obligations.

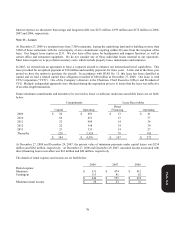

Lease Guarantees

As a result of (a) assigning our interest in obligations under real estate leases as a condition to the refranchising of certain

Company restaurants; (b) contributing certain Company restaurants to unconsolidated affiliates; and (c) guaranteeing

certain other leases, we are frequently contingently liable on lease agreements. These leases have varying terms, the latest

of which expires in 2026. As of December 27, 2008, the potential amount of undiscounted payments we could be

required to make in the event of non-payment by the primary lessee was approximately $425 million. The present value

of these potential payments discounted at our pre-tax cost of debt at December 27, 2008 was approximately $325 million.

Our franchisees are the primary lessees under the vast majority of these leases. We generally have cross-default

provisions with these franchisees that would put them in default of their franchise agreement in the event of non-payment

under the lease. We believe these cross-default provisions significantly reduce the risk that we will be required to make

payments under these leases. Accordingly, the liability recorded for our probable exposure under such leases at December

27, 2008 and December 29, 2007 was not material.

Form 10-K