Pizza Hut 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

In 2009, we currently expect to refranchise 500 restaurants in the U.S. The impact of this refranchising on our 2009

results will be determined by the stores that we are able to sell and the specific prices we are able to obtain for those

stores. In the first quarter of 2009, the expenses related to the U.S. G&A productivity initiatives and realignment of

resources are expected to total approximately $5 million and investments in our U.S. Brands are expected to total

approximately $25 million.

We currently anticipate ongoing G&A savings of approximately $70 million, primarily within the U.S. segment, as a

result of the U.S. business transformation measures we took in 2008 and will take in 2009.

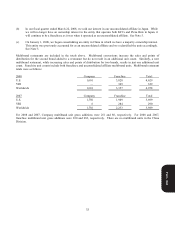

Mexico Value Added Tax (“VAT”) Exemption

On October 1, 2007, Mexico enacted new legislation that eliminated a tax ruling that allowed us to claim an exemption

related to VAT payments. Beginning on January 1, 2008, we were required to remit VAT on all Company restaurant sales

resulting in lower Company sales and Restaurant profit. As a result of this new legislation, our International Division’s

Company sales and Restaurant profit for the year ended December 27, 2008 were unfavorably impacted by approximately

$38 million and $34 million, respectively. The International Division’s system sales growth and restaurant margin as a

percentage of sales were negatively impacted by approximately 0.3 and 1.2 percentage points, respectively, for the year

ended December 27, 2008. For the first quarter of 2009, the negative lapping impact is expected to be $4 million after

which there will be no impact on subsequent quarters in 2009.

Tax Legislation – Mainland China

On March 16, 2007, the National People’s Congress in mainland China enacted new tax legislation that went into effect

on January 1, 2008. Upon enactment, which occurred in the China Division’s 2007 second fiscal quarter, the deferred tax

balances of all Chinese entities, including our unconsolidated affiliates, were adjusted. These income tax rate changes

positively impacted our 2008 net income by approximately $20 million compared to what it would have otherwise been

had no new tax legislation been enacted. The impacts on our income tax provision and operating profit in the year ended

December 29, 2007 were not significant.

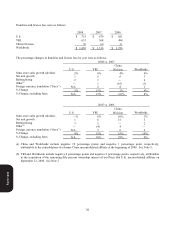

Pizza Hut United Kingdom Acquisition

On September 12, 2006, we completed the acquisition of the remaining fifty percent ownership interest of our Pizza Hut

United Kingdom (“U.K.”) unconsolidated affiliate from our partner, paying approximately $178 million in cash, including

transaction costs and net of $9 million of cash assumed. Additionally, we assumed the full liability, as opposed to our

fifty percent share, associated with the Pizza Hut U.K.’s capital leases of $97 million and short-term borrowings of $23

million. This unconsolidated affiliate operated more than 500 restaurants in the U.K. at the date of acquisition.

Prior to the acquisition, we accounted for our fifty percent ownership interest using the equity method of accounting.

Thus, we reported our fifty percent share of the net income of the unconsolidated affiliate (after interest expense and

income taxes) as Other (income) expense in the Consolidated Statements of Income. We also recorded a franchise fee for

the royalty received from the stores owned by the unconsolidated affiliate. Since the date of the acquisition, we have

reported Company sales and the associated restaurant costs, G&A expense, interest expense and income taxes associated

with the restaurants previously owned by the unconsolidated affiliate in the appropriate line items of our Consolidated

Statement of Income. We no longer record franchise fee income for the restaurants previously owned by the

unconsolidated affiliate, nor do we report other income under the equity method of accounting. As a result of this

acquisition, Company sales and restaurant profit increased $576 million and $59 million, respectively, franchise fees

decreased $19 million and G&A expenses increased $33 million in the year ended December 29, 2007 compared to the

year ended December 30, 2006.

Form 10-K