Pizza Hut 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23MAR200920294881

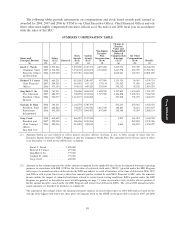

Review of Total Compensation

We intend to continue our strategy of compensating our executives through programs that emphasize

performance-based compensation. To that end, executive compensation through annual incentives and

stock appreciation rights/stock option grants is tied directly to our performance and is structured to ensure

that there is an appropriate balance between our financial performance and shareholder return. The

Compensation Committee reviewed each element of compensation and believes that the compensation

was reasonable in its totality. In addition, the Committee believes that various elements of this program

effectively achieve the objective of aligning compensation with performance measures that are directly

related to the Company’s financial goals and creation of shareholder value without encouraging executives

to take unnecessary and excessive risks.

Before finalizing compensation actions with regard to our CEO, the Compensation Committee took

into consideration all elements of compensation accruing to Mr. Novak in 2008. These elements included

salary, annual incentive award, and long-term incentive awards. Total compensation for each of the named

executive officers was reviewed by the Compensation Committee for 2008. Before finalizing compensation

for 2008, the Compensation Committee considered each named executive officer’s salary, annual incentive

award, stock appreciation rights awards, value of outstanding equity awards (vested and unvested), lump

sum value of pension at retirement and gains realized from exercising stock options. The Compensation

Committee will continue to review total compensation at least once a year.

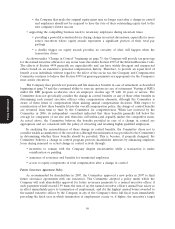

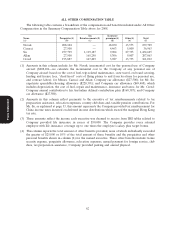

YUM’s Executive Stock Ownership Guidelines

The Committee has established stock ownership guidelines for our top 600 employees. Our Chief

Executive Officer is required to own 336,000 shares of YUM stock or stock equivalents (approximately

seven times his base salary). Senior Leadership Team members (other than Mr. Novak) are expected to

attain their ownership targets, equivalent in value to two to three times their current annual base salary

depending upon their positions, within five years from the time the established targets become applicable.

Each named executive officer’s ownership requirement was increased from 24,000 to 50,000 shares for

2008. If an executive does not meet his or her ownership guideline, he or she is not eligible for a grant

under the LTI Plan. In 2008, all Senior Leadership Team members and all other employees subject to

Proxy Statement

guidelines met or exceeded their ownership guidelines.

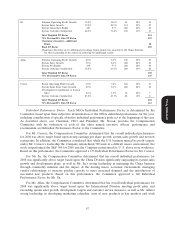

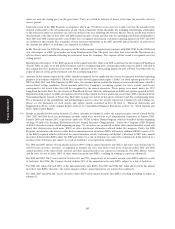

Shares and RSUs Value of Shares/RSUs

Ownership Owned by Owned as Multiple

Guidelines NEO(1) of Salary(2)

Novak 336,000 2,030,190 43

Carucci 50,000 123,389 5

Allan 50,000 334,214 13

Su 50,000 290,358 11

Creed 50,000 71,046 3

(1) Calculated as of December 31, 2008 and represents shares owned outright by the NEO and RSUs

acquired under the Company’s executive income deferral program.

(2) Assumes Yum stock price of $30.00.

YUM’s Stock Option and Stock Appreciation Rights Granting Practices

Historically, we have always awarded non-qualified stock option and stock appreciation rights grants

annually at the Compensation Committee’s January meeting. This meeting date is set by the Board of

Directors more than 6 months prior to the actual meeting. Beginning with the 2009 grant, the Committee

54