Pizza Hut 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

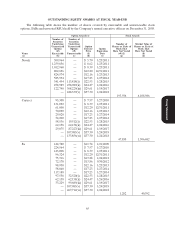

23MAR200920294881

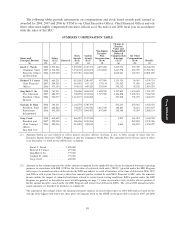

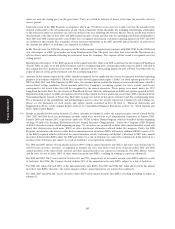

where we used the closing price on the grant date). Units are settled by delivery of shares at the time the executive elects to

receive payout.

Under the terms of the EID Program, an employee who is age 55 with 10 years of service is fully vested in the amount of the

deferral attributable to the actual incentive award. Upon attainment of this threshold, the matching contributions attributable

to the deferral is subject to forfeiture on a pro rata basis for the year following the deferral. Messrs. Novak and Su had attained

this threshold at the time of their 2007 and 2008 annual incentive awards and thus only the matching contribtions attributable to

their 2007 and 2008 annual incentive awards that were recognized for financial statement reporting purposes in 2007 and 2008

are included in this column. The remainder of their deferrals attributable to the 2007 and 2008 annual incentive awards (that is

the amount not subject to forfeiture) are reported in column (f).

In Mr. Novak’s case, for 2008 this also represents the dollar amount recognized in accordance with FAS 123R for the 2008 fiscal

year with respect to a RSU grant under our Long Term Incentive Plan. The grant vests after four years and Mr. Novak may not

sell the shares until 6 months following his retirement from the Company. The expense of this award is recognized over the

vesting period.

Information with respect to the RSUs granted to the named executive officers in 2008 is disclosed in the Grants of Plan-Based

Awards Table on page 63 of this proxy statement and the accompanying notes. Information with respect to RSUs reflected in

this column that were granted in years before 2008 is disclosed in the Outstanding Equity Awards at Fiscal Year-End table on

pages 65 and 66 of this proxy statement and the accompanying notes.

(3) Amounts in this column represent the dollar amount recognized for the applicable fiscal years for financial statement reporting

purposes in accordance with FAS 123R for the fair value of stock appreciation rights (‘‘SARs’’) or stock options granted to each

NEO in 2008, 2007 and 2006. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to

service-based vesting conditions. These amounts reflect the Company’s accounting expense for these awards, and do not

correspond to the actual value that will be recognized by the named executives. These grants were made under the 1999

Long-Term Incentive Plan. See the Grants of Plan-Based Awards Table for information on SARs and options granted in 2008.

Information with respect to SARs and options reflected in this column that were granted in years before 2008 is disclosed in the

Outstanding Equity Awards at Fiscal Year-End table on pages 65 and 66 of this proxy statement and the accompanying notes.

For a discussion of the assumptions and methodologies used to value the awards reported in Column (d) and Column (e),

please see the discussion of stock awards and option awards contained in Part II, Item 8, ‘‘Financial Statements and

Supplementary Data’’ of the Annual Report in Notes to Consolidated Financial Statements at Note 16, ‘‘Stock Options and

Stock Appreciation Rights.’’

(4) Except as provided below and in footnote (2) above, amounts in column (f) reflect the annual incentive awards earned for the

2008, 2007 and 2006 fiscal year performance periods, which were awarded by our Compensation Committee in January 2009,

January 2008 and January 2007, respectively, under the YUM! Leaders’ Bonus Program, which is described further beginning

on page 44 under the heading ‘‘Performance-Based Annual Incentive Compensation’’. Under the Company’s EID Program

Proxy Statement

(which is described in more detail beginning on page 71), executives are permitted to defer their annual incentive award and

invest that deferral into stock units, RSUs or other investment alternatives offered under the program. Under the EID

Program, an executive who elects to defer his/her annual incentive award into RSUs will receive additional RSUs equal to 33%

of the RSUs acquired with the deferral of the annual incentive award (‘‘matching contribution’’). Pursuant to SEC rules, annual

incentives deferred into RSUs under the EID and subject to a risk of forfeiture are reported in column (d). If the deferral or a

portion of the deferral is not subject to a risk of forfeiture, it is reported in column (f).

For 2008 and 2007, Messrs. Novak and Su deferred 100% of their annual incentives into RSUs, and since each attained age 55

with 10 years of service, therefore, as explained in footnote (2), they were fully vested in the deferral of their 2007 and 2008

annual incentive at the time of their deferral and their annual incentives are reported in column (f). For 2006, Messrs. Novak

and Su each elected to defer 100% of their annual incentive into RSUs, resulting in nothing to report in column (f).

For 2008 and 2007, Mr. Carucci elected to defer 56% and 70%, respectively, of his annual incentive into RSUs subject to a risk

of forfeiture. For 2006, Mr. Carucci elected to defer 50% of his annual incentive into RSUs subject to a risk of forfeiture.

For 2008, Mr. Allan deferred 100% of his annual incentive into RSUs. For 2007 and 2006, Mr. Allan did not defer his annual

incentives into RSUs; therefore, the entire amount of these annual incentives are reported in column (f).

For 2008, 2007 and 2006, Mr. Creed elected to defer 100% of his annual incentive into RSUs, resulting in nothing to report in

column (f).

60