Pizza Hut 2008 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

On July 11, 2008 we entered into a variable rate senior unsecured term loan (“Domestic Term Loan”), in an aggregate

principal amount of $375 million that matures in three years. At our discretion the variable rate resets at one, two, three or

six month intervals. We determine whether the variable rate at each reset date is based upon: (1) LIBOR plus an

applicable spread of up to 2.5%, or (2) an Alternate Base Rate. The Alternate Base Rate is the greater of the Prime Rate

or the Federal Funds Rate plus 0.50%, plus an applicable spread of up to 1.5%. The proceeds from the Domestic Term

Loan were used for general corporate purposes.

The Credit Facility, Domestic Term Loan, and the ICF are unconditionally guaranteed by our principal domestic

subsidiaries. Additionally, the ICF is unconditionally guaranteed by YUM. These agreements contain financial

covenants relating to maintenance of leverage and fixed charge coverage ratio and also contain affirmative and negative

covenants including, among other things, limitations on certain additional indebtedness and liens, and certain other

transactions specified in the agreement. Given the Company’s strong balance sheet and cash flows we were able to

comply with all debt covenant requirements at December 27, 2008 with a considerable amount of cushion.

The majority of our remaining long-term debt primarily comprises Senior Unsecured Notes with varying maturity dates

from 2011 through 2037 and interest rates ranging from 6.25% to 8.88%. The Senior Unsecured Notes represent senior,

unsecured obligations and rank equally in right of payment with all of our existing and future unsecured unsubordinated

indebtedness. Amounts outstanding under Senior Unsecured Notes were $2.6 billion at December 27, 2008. In May

2008, $250 million of Senior Unsecured Notes matured, and the repayment was funded with additional borrowings under

our Credit Facility.

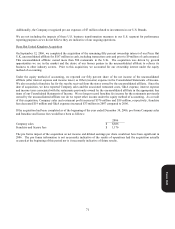

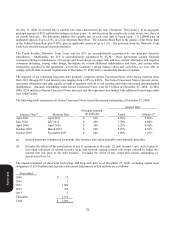

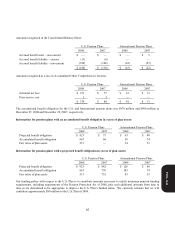

The following table summarizes all Senior Unsecured Notes issued that remain outstanding at December 27, 2008:

Interest Rate

Issuance Date(a) Maturity Date

Principal Amount

(in millions) Stated Effective(b)

April 2001 April 2011 $ 650 8.88% 9.20%

June 2002 July 2012 $ 400 7.70% 8.04%

April 2006 April 2016 $ 300 6.25% 6.03%

October 2007 March 2018 $ 600 6.25% 6.38%

October 2007 November 2037 $ 600 6.88% 7.29%

(a) Interest payments commenced six months after issuance date and are payable semi-annually thereafter.

(b) Includes the effects of the amortization of any (1) premium or discount; (2) debt issuance costs; and (3) gain or

loss upon settlement of related treasury locks and forward starting interest rate swaps utilized to hedge the

interest rate risk prior to the debt issuance. Excludes the effect of any swaps that remain outstanding as

described in Note 14.

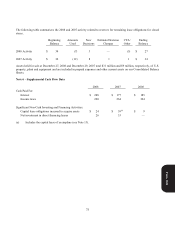

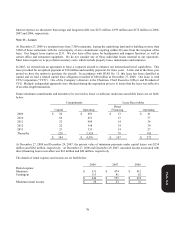

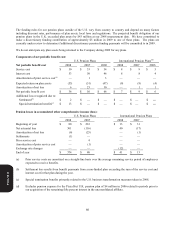

The annual maturities of short-term borrowings and long-term debt as of December 27, 2008, excluding capital lease

obligations of $234 million and derivative instrument adjustments of $59 million, are as follows:

Year ended:

2009 $ 12

2010 3

2011 1,029

2012 704

2013 5

Thereafter 1,551

Total $ 3,304

Form 10-K