Pizza Hut 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

The funding rules for our pension plans outside of the U.S. vary from country to country and depend on many factors

including discount rates, performance of plan assets, local laws and regulations. Our most significant plans are in the

U.K. The projected benefit obligation of our pension plans in the U.K. exceeded plan assets by $43 million at our 2008

measurement date. We have committed to make a discretionary funding contribution of approximately $5 million in 2009

to one of these plans. The plans are currently under review to determine if additional discretionary pension funding

payments will be committed to in 2009.

Our postretirement plan in the U.S. is not required to be funded in advance, but is pay as you go. We made postretirement

benefit payments of $5 million in 2008 and no future funding amounts are included in the contractual obligations table.

See Note 15 for further details about our pension and postretirement plans.

We have excluded from the contractual obligations table payments we may make for exposures for which we are self-

insured, including workers’ compensation, employment practices liability, general liability, automobile liability, product

liability and property losses (collectively “property and casualty losses”) and employee healthcare and long-term

disability claims.

The majority of our recorded liability for self-insured employee healthcare, long-term disability and property and casualty

losses represents estimated reserves for incurred claims that have yet to be filed or settled.

Off-Balance Sheet Arrangements

We have provided a partial guarantee of approximately $16 million of a franchisee loan program used primarily to assist

franchisees in the development of new restaurants and, to a lesser extent, in connection with the Company’s historical

refranchising programs at December 27, 2008. We have also provided two letters of credit totaling approximately $23

million in support of the franchisee loan program. One such letter of credit could be used if we fail to meet our

obligations under our guarantee. The other letter of credit could be used, in certain circumstances, to fund our

participation in the funding of the franchisee loan program. The total loans outstanding under the loan pool were

approximately $48 million at December 27, 2008.

Our unconsolidated affiliates had approximately $51 million and $22 million of debt outstanding as of December 27, 2008

and December 29, 2007, respectively.

New Accounting Pronouncements Not Yet Adopted

See Note 2 to the Consolidated Financial Statements included in Part II, Item 8 of this report for further details of new

accounting pronouncements not yet adopted.

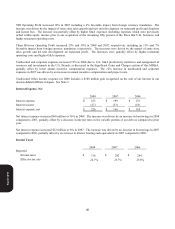

Critical Accounting Policies and Estimates

Our reported results are impacted by the application of certain accounting policies that require us to make subjective or

complex judgments. These judgments involve estimations of the effect of matters that are inherently uncertain and may

significantly impact our quarterly or annual results of operations or financial condition. Changes in the estimates and

judgments could significantly affect our results of operations, financial condition and cash flows in future years. A

description of what we consider to be our most significant critical accounting policies follows.

Form 10-K