Neiman Marcus 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

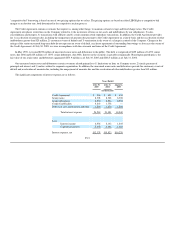

administrative expenses) and $3.9 million in 2004 were required based upon revised estimates of future cash flows.

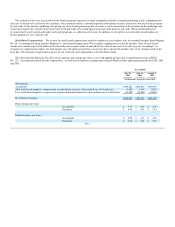

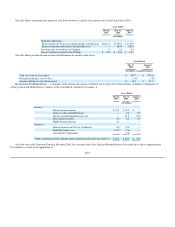

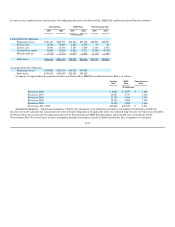

NOTE 4. Accrued Liabilities

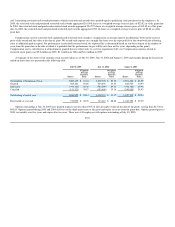

The significant components of accrued liabilities are as follows:

July 30,

2005

July 31,

2004

(in thousands)

Accrued salaries and related liabilities $ 67,343 $ 63,452

Amounts due customers 44,214 40,318

Self-insurance reserves 43,209 39,067

Sales returns reserves 35,739 31,487

Income taxes payable 19,702 12,519

Loyalty program liability 16,780 14,283

Sales tax 15,112 12,712

Other 90,838 72,995

Total $332,937 $286,833

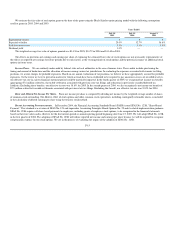

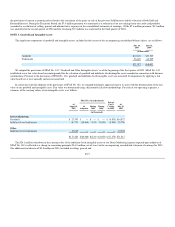

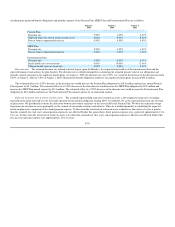

NOTE 5. Long-term Debt

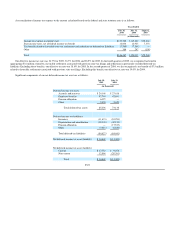

The significant components of our long-term debt are as follows:

Interest

Rate

July 30,

2005

July 31,

2004

(in thousands)

Senior unsecured notes 6.65% $124,957 $124,941

Senior unsecured debentures 7.125% 124,823 124,816

Credit Card Facility LIBOR + 0.27% — 225,000

249,780 474,757

Less: current portion — 150,000

Long-term debt $249,780 $324,757

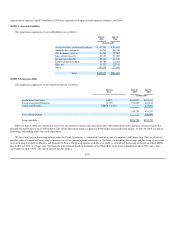

Effective June 9, 2004, we entered into a five-year unsecured revolving credit agreement (the Credit Agreement) with a group of seventeen banks that

provides for borrowings of up to $350 million. The Credit Agreement replaces a previous $300 million unsecured credit facility. At July 30, 2005, we had no

borrowings outstanding under the Credit Agreement.

We have two types of borrowing options under the Credit Agreement, a "committed" borrowing and a "competitive bid" borrowing. The rate of interest

payable under a "committed" borrowing is based on one of two pricing options selected by us, the level of outstanding borrowings and the rating of our senior

unsecured long-term debt by Moody's and Standard & Poor's. The pricing options available to us under a "committed" borrowing are based on either LIBOR

plus 0.40% to 1.50% or a "base" rate. The base rate is determined based on the higher of the Prime Rate or the Federal Funds Rate plus 0.50% and a "base"

rate margin of up to 0.50%. The rate of interest payable under a

F-20