Neiman Marcus 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

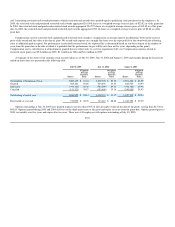

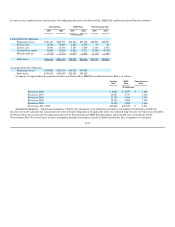

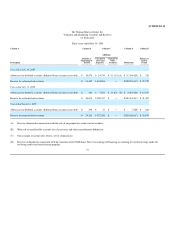

The projected benefit obligation of the Pension Plan exceeded the plan's assets by $73.2 million in 2005 and $38.3 million in 2004. The underfunded

status is reflected in our consolidated balance sheets as follows:

2005 2004

Prepaid pension contribution reflected in the consolidated balance sheets and not yet charged to expense $ 48,697 $ 45,554

Liability charged to shareholders' equity and not yet recognized in expense (64,491) —

Liability reflected in other assets and not yet charged to expense (2) —

Unrecognized liability not yet recognized in expense (57,371) (83,880)

Underfunded status $(73,167) $(38,326)

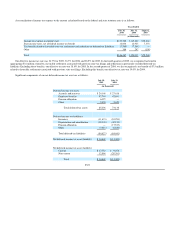

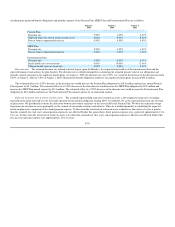

The unrecognized liability of $57.4 million for the Pension Plan at July 30, 2005 relates primarily to the delayed recognition of differences between our

actuarial assumptions and actual results. In addition, we had cumulative unrecognized liabilities for the SERP Plan and Postretirement Plan aggregating

$25.4 million at July 30, 2005.

NOTE 9. Loss on Disposition of Chef's Catalog

In November 2004, we sold our Chef's Catalog direct marketing business to a private equity firm. Chef's Catalog is a multi-channel retailer of

professional-quality kitchenware with revenues of approximately $73 million in fiscal year 2004. At October 30, 2004, Chef's Catalog had net tangible assets,

primarily inventory, of $12.5 million and net intangible assets of $17.2 million. We received proceeds, net of selling costs, of $14.4 million from the sale. As

the carrying value of the Chef's Catalog assets exceeded the net proceeds from the sale, we incurred a pretax loss of $15.3 million in the first quarter of 2005

related to the disposition of Chef's Catalog.

NOTE 10. Commitments and Contingencies

Leases. We lease certain property and equipment under various non-cancelable capital and operating leases. The leases provide for monthly fixed

rentals and/or contingent rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area

maintenance costs and other occupancy costs. Generally, the leases have primary terms ranging from one to 99 years and include renewal options ranging

from five to 80 years.

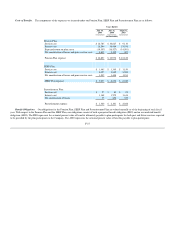

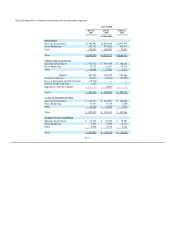

Rent expense under operating leases is as follows:

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands)

Minimum rent $42,300 $37,600 $37,300

Contingent rent 23,800 20,300 16,500

Total rent expense $66,100 $57,900 $53,800

F-33