Neiman Marcus 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

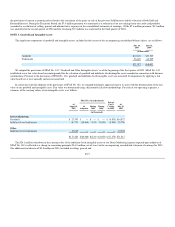

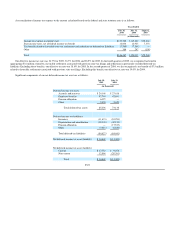

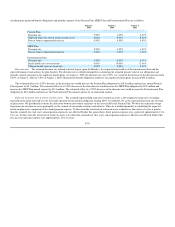

and 3) matching restricted stock awards pursuant to which restricted stock awards were granted equal to qualifying stock purchases by the employees. In

2005, the restricted stock and purchased restricted stock awards aggregated 261,998 shares at a weighted-average exercise price of $23.82 as of the grant date.

In 2004, the restricted stock and purchased restricted stock awards aggregated 254,757 shares at a weighted-average exercise price of $15.89 as of the grant

date. In 2003, the restricted stock and purchased restricted stock awards aggregated 105,110 shares at a weighted-average exercise price of $8.88 as of the

grant date.

Compensation cost for restricted stock and purchased restricted stock awards is recognized in an amount equal to the difference between the exercise

price of the award and fair value at the date of grant. We record such expense on a straight-line basis over the expected life of the award with the offsetting

entry to additional paid-in capital. For performance accelerated restricted stock, the expected life is determined based on our best estimate of the number of

years from the grant date to the date at which it is probable that the performance targets will be met (four or five years, depending on the grant).

Compensation cost is calculated as if all instruments granted that are subject only to a service requirement will vest. Compensation expense related to

restricted stock grants was $5.0 million in 2005, $3.1 million in 2004 and $2.4 million in 2003.

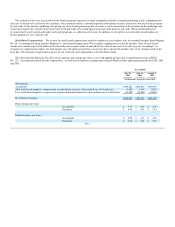

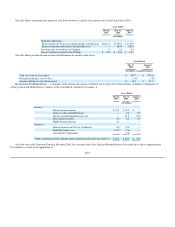

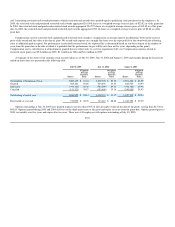

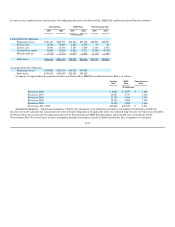

A summary of the status of our common stock incentive plans as of July 30, 2005, July 31, 2004 and August 2, 2003 and changes during the fiscal years

ended on those dates are presented in the following table:

July 30, 2005 July 31, 2004 August 2, 2003

Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

Outstanding at beginning of year 3,009,155 $ 33.35 3,079,705 $ 29.54 2,894,300 $ 28.59

Granted 569,161 56.89 903,650 43.33 822,525 30.93

Exercised (376,140) 28.38 (780,600) 29.34 (392,300) 25.96

Canceled (151,321) 38.87 (193,600) 35.16 (244,820) 28.93

Outstanding at end of year 3,050,855 $ 38.12 3,009,155 $ 33.37 3,079,705 $ 29.54

Exercisable at year end 717,890 $ 28.76 713,110 $ 28.68 1,012,790 $ 29.39

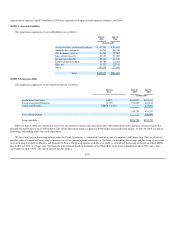

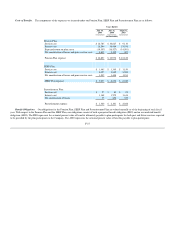

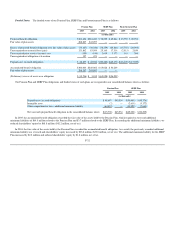

Options outstanding at July 30, 2005 were granted at prices (not less than 100% of the fair market value on the date of the grant) varying from $15.38 to

$60.83. Options granted during 2005 and 2004 cliff vest on the third anniversary of the grant and expire six years from the grant date. Options granted prior to

2003 vest ratably over five years and expire after ten years. There were 149 employees with options outstanding at July 30, 2005.

F-23