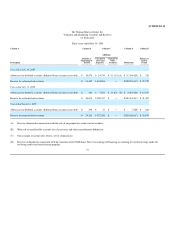

Neiman Marcus 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMENDED AND RESTATED DISTRIBUTION AGREEMENT

AMENDED AND RESTATED DISTRIBUTION AGREEMENT, dated as of July 1, 1999, amending and restating the DISTRIBUTION

AGREEMENT, dated as of May 14, 1999 (this "Agreement"), between HARCOURT GENERAL, INC., a Delaware corporation ("Harcourt General"), and

THE NEIMAN MARCUS GROUP, INC., a Delaware corporation ("Neiman Marcus").

WHEREAS, Harcourt General will own, immediately prior to the Recapitalization (as defined below), 21,440,960 shares of Common Stock, par value $.

01 per share, of Neiman Marcus ("Common Stock") and HGI Investment Trust, a wholly-owned subsidiary of Harcourt General ("HGI"), will own 4,988,542

shares of Common Stock (the "Retained Shares");

WHEREAS, simultaneously with the execution hereof, Neiman Marcus and Spring Merger Corporation, a Delaware corporation and a wholly-owned

subsidiary of Harcourt General ("Merger Sub"), are entering into an Amended and Restated Agreement and Plan of Merger dated as of the date hereof (as

amended, supplemented or otherwise modified from time to time, the "Recapitalization Agreement"), pursuant to which, among other things, Merger Sub will

merge with and into Neiman Marcus with the following consequent capital stock changes: (i) 21,440,960 shares of the Common Stock held by Harcourt

General will be contributed to Merger Sub and, as of the Declaration Date (as defined herein), will automatically be canceled and retired with no securities or

other consideration issued in exchange therefor, (ii) all of the common stock of Merger Sub, owned by Harcourt General, will be converted into 21,440,960

shares of a new Class B Common Stock, par value $.01 per share, of Neiman Marcus ("Class B Common Stock" and, together with the Class A Common

Stock, the "Neiman Marcus Common Stock"), which class of stock will be entitled to elect at least 82% of the members of the board of directors of Neiman

Marcus and in all other respects will be substantially identical to the Class A Common Stock and (iii) all other shares of Common Stock will be converted into

Class A Common Stock, par value $.01 per share, of Neiman Marcus ("Class A Common Stock"), including 4,988,542 shares of Common Stock held by HGI,

which class of stock shall be entitled to elect up to 18% of the members of the board of directors of Neiman Marcus (the "Recapitalization");

WHEREAS, the Board of Directors of Harcourt General has determined that it is appropriate, desirable and in the best interests of Harcourt General and

its stockholders to distribute on the Distribution Date all the shares of Class B Common Stock that Harcourt General will receive in the Recapitalization, on

the terms and subject to the conditions set forth in this Agreement, to the holders of record of the Common Stock, par value $1.00 per share, of Harcourt

General and the Class B Stock, par value $1.00 per share, of Harcourt General (collectively, "Harcourt General Common Stock"), as of the Distribution

Record Date (as defined herein), on a pro rata basis (the "Distribution");

WHEREAS, Harcourt General will submit a request for a ruling (as it may be amended from time to time, the "Ruling Request") from the Internal

Revenue Service to the effect that the Distribution will be a tax-free distribution within the meaning of Section 355 of the Code (as defined herein);

WHEREAS, each of Harcourt General and Neiman Marcus has determined that it is necessary and desirable to set forth the principal corporate

transactions required to effect the Distribution and the Recapitalization and to set forth other agreements that will govern certain other matters following the

Distribution.

B-1