Neiman Marcus 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for 15.5% of our total revenues and generated operating earnings of $75.2 million, or 12.7% of Direct Marketing revenues.

In recent years, we have achieved industry-leading financial performance, including strong growth in sales per square foot and comparable revenues,

along with stable operating margins and significant cash flow generation. Our Neiman Marcus and Bergdorf Goodman stores generated sales per square foot

of $577 in 2005.

For more information about our reportable segments, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of

Operations" and Note 14 of the Notes to Consolidated Financial Statements in Item 15.

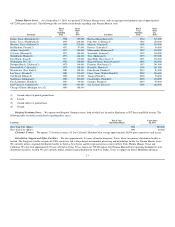

Our fiscal year ends on the Saturday closest to July 31. All references to 2005 relate to the 52 weeks ended July 30, 2005; all references to 2004 relate to

the 52 weeks ended July 31, 2004 and all references to 2003 relate to the 52 weeks ended August 3, 2003. References to 2006 and years thereafter relate to

our fiscal years for such periods.

We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments, available free of

charge through our website at www.neimanmarcusgroup.com as soon as reasonably practicable after we electronically file such material with (or furnish such

material to) the Securities and Exchange Commission. The information contained on our website is not incorporated by reference into this Form 10-K and

should not be considered to be part of this Form 10-K.

Recent Developments

On May 1, 2005, our Board of Directors approved a definitive agreement to sell the Company to an investment group consisting of Texas Pacific Group

and Warburg Pincus, LLC (collectively, the Sponsors). Under the terms of the agreement, the Sponsors will acquire all of the outstanding Class A and Class B

shares of The Neiman Marcus Group, Inc. for $100.00 per share in cash, representing a transaction value of approximately $5.1 billion. Each of the Sponsors

will own equal stakes in the Company upon completion of the transaction. Our shareholders approved the definitive agreement to sell the Company on

August 16, 2005. The sale is currently anticipated to close in October 2005.

In connection with the Sponsors' purchase of the Company, the Company will incur significant indebtedness and will be highly leveraged. See "The

Transactions." Significant additional liquidity requirements (resulting primarily from debt service requirements) and other factors relating to the Transactions

will significantly affect our future financial position, results of operations and liquidity.

Industry Overview

We operate in the luxury apparel and accessories segment of the U.S. retail industry and have arrangements with luxury-branded fashion vendors,

including Chanel, Prada, St. John, David Yurman, Ermenegildo Zegna, Gucci, Giorgio Armani and Manolo Blahnik to market and sell their merchandise.

Luxury-branded fashion vendors typically manage the distribution and marketing of their merchandise to maximize the perception of brand exclusivity and to

facilitate the sale of their goods at premium prices, including by limiting the number of retail locations through which they distribute their merchandise. These

retail locations typically consist of a limited number of specialty stores, high-end department stores and, in some instances, vendor-owned proprietary

boutiques. Retailers that compete with us for the distribution of luxury fashion brands include Saks Fifth Avenue, Nordstrom, Barney's New York and other

national, regional and local retailers.

3