Neiman Marcus 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on a total of 569,161 shares subject to options granted to employees under the 1997 Plan during fiscal year 2005.

In accordance with SEC rules, the dollar amounts under these columns are not intended to forecast possible future appreciation, if any, of the

Company's stock price.

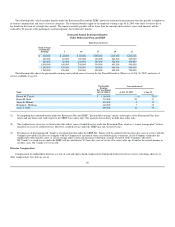

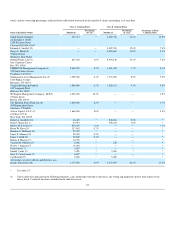

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

Number of Securities

Underlying Unexercised

Options at July 30, 2005 (#)

Value of Unexercised

In-the-Money Options at July 30, 2005 ($)(1)

Name

Shares

Acquired on

Exercise (#)

Value

Realized ($) Exercisable Unexercisable Exercisable Unexercisable

Burton M. Tansky 0 0 313,600 175,600 22,311,825 10,931,525

Karen M. Katz 11,000 458,554 47,500 99,000 3,066,469 6,285,475

James E. Skinner 0 0 20,000 61,000 1,384,600 3,863,170

Brendan L. Hoffman 0 0 7,300 93,242 501,112 4,916,545

James J. Gold 2,300 64,250 0 28,600 0 1,591,680

The value of unexercised in-the-money options is calculated by multiplying the number of underlying shares by the difference between the closing

price of the Company's Class A common stock on the NYSE at fiscal 2005 year-end ($98.50) less the option exercise price for those shares. These

values have not been realized.

PENSION PLAN TABLE

We maintain a funded, qualified pension plan known as The Neiman Marcus Group, Inc. Retirement Plan (the "Retirement Plan"). Most non-union

employees over age 21 who have completed one year of service with 1,000 or more hours participate in the Retirement Plan, which pays benefits upon

retirement or termination of employment. The Retirement Plan is a "career-average" plan, under which a participant earns each year a retirement annuity equal

to 1 percent of his or her compensation for the year up to the Social Security wage base and 1.5 percent of his or her compensation for the year in excess of

such wage base. Benefits under the Retirement Plan become fully vested after five years of service with us.

We also maintain a Supplemental Executive Retirement Plan (the "SERP"). The SERP is an unfunded, nonqualified plan under which benefits are paid

from our general assets to supplement Retirement Plan benefits and Social Security. Executive, administrative and professional employees (other than those

employed as salespersons) with an annual base salary at least equal to a minimum established by the Company ($160,000 as of July 30, 2005) are eligible to

participate. At normal retirement age (age 65), a participant with 25 or more years of service is entitled to payments under the SERP sufficient to bring his or

her combined annual benefit from the Retirement Plan and SERP, computed as a straight life annuity, up to 50 percent of the participant's highest consecutive

60 month average of annual pensionable earnings, less 60 percent of his or her estimated annual primary Social Security benefit. If the participant has fewer

than 25 years of service, the combined benefit is proportionately reduced. Benefits under the SERP become fully vested after five years of service with us.

55

(2)

(3)

(1)