Neiman Marcus 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LLC has in turn delivered an equity commitment letter to Merger Sub for $1.55 billion, the aggregate amount of the equity commitments. Each of the

Sponsors may assign its commitment to purchase up to 49% of the equity interests in Newton Holding, LLC to other investors, so long as each such investor

agrees to be bound by the obligations of the applicable Sponsor.

Each of the equity commitment letters provides that the equity funds will be contributed on or prior to the closing of the merger to fund a portion of the

total merger consideration, pursuant to and in accordance with the merger agreement, and to satisfy any liabilities or obligations of Merger Sub's corporate

parent, Newton Acquisition, Inc. (Parent) or Merger Sub arising out of or in connection with any breach by Parent or Merger Sub of their respective

obligations under the merger agreement. Each of the equity commitments is generally subject to the satisfaction of the conditions to Parent and Merger Sub's

obligations to effect the closing under the merger agreement. Each of the equity commitment letters will terminate upon termination of the merger agreement

unless:

the merger agreement is terminated by us due to a breach by either Parent or Merger Sub of any of its respective representations, warranties,

covenants or agreements under the merger agreement such that the conditions to closing would not be satisfied; or

the merger agreement is otherwise terminated pursuant to a breach by Parent or Merger Sub of their respective obligations under the merger

agreement and we are not in breach of our obligations under the merger agreement.

In the event the merger agreement is terminated pursuant to a circumstance described in the foregoing two bullet points, then each of the equity

commitment letters will terminate three months after the termination of the merger agreement except with respect to any claims arising from or in connection

with any lawsuits filed by us against Parent or Merger Sub prior to the expiration of such three-month period. Under certain circumstances, in connection with

the termination of the merger agreement, we will be required to pay Parent $140.3 million in termination fees.

In the event that we terminate the merger agreement because Parent (i) breaches its obligations to effect the closing and satisfy its obligations with

respect to payment of the merger consideration when all conditions to the closing are satisfied and the marketing period has expired and (ii) Parent fails to

effect the closing because of a failure to receive the proceeds of one or more of the debt financings contemplated by the debt financing commitments or

because of its refusal to accept debt financing on terms materially less beneficial to it than the terms set forth in the debt financing commitments, Merger Sub

will be required to pay us a $140.3 million termination fee. This termination fee payable to us is our exclusive remedy unless, in general, Parent is otherwise

in breach of the merger agreement, in which case we may pursue a damages claim. The aggregate liability of Parent and its affiliates arising from any breach

of the merger agreement is in any event capped at $500,000,000.

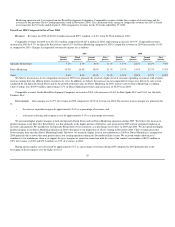

In connection with the Sponsors' purchase of the Company, the Company will incur significant indebtedness and will be highly leveraged. See "Liquidity

and Capital Resources—Financing Structure Related to the Acquisition." In addition, the Transaction will be accounted for using purchase accounting

whereby the purchase price paid to effect the Transactions will be allocated to state the acquired assets and liabilities at fair value. We believe the purchase

accounting adjustments will increase the carrying value of our property and equipment, establish intangible assets for our tradenames, customer lists and

favorable lease commitments and revalue our long-term benefit plan obligations, among other things. Subsequent to the Transactions, interest expense and

non-cash depreciation and amortization charges will significantly increase. As a result, our financial statements subsequent to the Transactions will not be

comparable to our historical financial statements.

19

•

•