Neiman Marcus 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

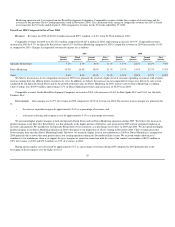

With the introduction of new fashions in the first and third quarters and our emphasis on full-price selling in these quarters, a lower level of markdowns

and higher margins are characteristic of these quarters.

Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale.

Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we earn in connection with the sales of the vendor's

merchandise. These allowances result in an increase to gross margin when we earn the allowances and they are approved by the vendor. Other allowances we

receive represent reductions to the amounts we pay to acquire the merchandise. These allowances reduce the cost of the acquired merchandise and are

recognized as an increase to gross margin at the time the goods are sold. Vendor allowances received were $83.5 million in 2005 and $79.3 million in 2004.

Changes in our gross margins are affected primarily by the following factors:

customer acceptance of and demand for the merchandise we offer in a given season and the related impact of such factors on the level of full-

price sales;

our ability to order an appropriate amount of merchandise to match customer demand and the related impact on the level of net markdowns

incurred;

factors affecting revenues generally;

changes in occupancy costs primarily associated with the opening of new stores or distribution facilities; and

the amount of vendor reimbursements we receive during the fiscal year.

Selling, general and administrative expenses. Selling, general and administrative (SG&A) expenses principally comprise costs related to employee

compensation and benefits in the selling and administrative support areas, advertising and catalog costs, insurance expense and income and expenses related

to our proprietary credit card portfolio. A significant portion of our selling, general and administrative expenses are variable in nature and are dependent on

the sales we generate.

Prior to the Credit Card Sale on July 7, 2005, our credit operations generated finance charge income, net of credit losses, which we recognized as income

when earned and recorded as a reduction of selling, general and administrative expenses. As a part of the Credit Card Sale, we entered into a long-term

marketing and servicing alliance with HSBC. Under the terms of this alliance, HSBC offers credit card and non-card payment plans bearing our brands and

we receive ongoing payments from HSBC related to credit card sales and compensation for marketing and servicing activities (HSBC Program Income). We

record the HSBC Program Income as a reduction of selling, general and administrative expenses.

Advertising costs incurred by our Specialty Retail segment consist primarily of print media costs related to promotional materials mailed to our

customers, while advertising costs incurred by our Direct Marketing operation relate to the production, printing and distribution of our print catalogs and the

production of the photographic content on our websites, as well as online marketing costs. We receive advertising allowances from certain of our merchandise

vendors. Substantially all the advertising allowances we receive represent reimbursements of direct, specific and incremental costs that we incur to promote

the vendor's merchandise in connection with our various advertising programs, primarily catalogs and other print media. As a result, these allowances are

recorded as a reduction of our advertising costs when earned. Vendor allowances earned and recorded as a reduction to selling, general and administrative

expenses aggregated approximately $57.5 million in 2005 and $55.3 million in 2004.

21

•

•

•

•

•