Neiman Marcus 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

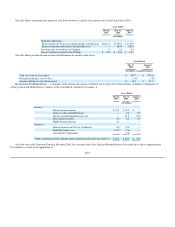

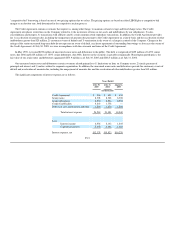

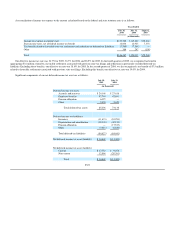

NOTE 2. Credit Card Receivables

Subsequent to the Credit Card Sale. On July 7, 2005, HSBC purchased our approximately three million private label Neiman Marcus and Bergdorf

Goodman credit card accounts and related assets, as well as the outstanding balances associated with such accounts (Credit Card Sale). The total purchase

price was approximately $647 million, consisting of approximately $534 million in net cash proceeds and the assumption of approximately $113 million of

outstanding debt under our revolving credit card securitization facility. We recognized a gain of $6.2 million in connection with the sale of our credit card

portfolio to HSBC.

As a part of the Credit Card Sale, we entered into a long-term marketing and servicing alliance with HSBC. Under the terms of this alliance, HSBC

offers credit card and non-card payment plans bearing our brands and we receive ongoing payments from HSBC related to credit card sales and compensation

for marketing and servicing activities (HSBC Program Income). In addition, we continue to handle key customer service functions, initially including new

account processing, most transaction authorization, billing adjustments, collection services and customer inquiries. In 2005, our credit card operations

generated net finance charge income of approximately $75.4 million. If the Credit Card Sale had been consummated as of the first day of 2005, we believe,

the HSBC Program Income for 2005 would have been at least $42 million. HSBC and the Company are currently in the process of implementing changes to

the proprietary credit card program that we expect will be fully implemented during the fourth quarter of 2006. Had such changes been fully implemented on

the first day of 2005, we believe the HSBC Program Income for 2005 would have been approximately $56 million.

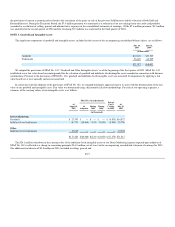

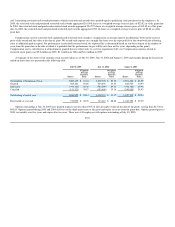

Prior to the Credit Card Sale. Prior to the Credit Card Sale on July 7, 2005, we transferred substantially all of our credit card receivables to a wholly-

owned subsidiary, Neiman Marcus Funding Corporation, which in turn sold such receivables to the Neiman Marcus Credit Card Master Trust (Trust) pursuant

to a revolving credit card securitization program (the Credit Card Facility). At the inception of the Credit Card Facility in September 2000, the Trust issued

certificates representing undivided interests in the credit card receivables to both third-party investors (Sold Interests) and to the Company (Retained

Interests). From the inception of the Credit Card Facility until December 2003, our transfers and sales of credit card receivables pursuant to the terms of the

Credit Card Facility were accounted for as sales (Off-Balance Sheet Accounting). As a result, $225.0 million of credit card receivables were removed from

our balance sheet at the inception of the Credit Card Facility and the Trust's $225.0 million repayment obligation to the holders of the certificates representing

the Sold Interests was not shown as a liability on our consolidated balance sheet.

The Sold Interests were represented by Class A Certificates, aggregating $225.0 million at face value. The holders of the Class A Certificates were

entitled to monthly interest distributions at the contractually-defined rate of one month LIBOR plus 0.27% annually. The distributions to the Class A

Certificate holders were payable from the finance charge income generated by the credit card receivables held by the Trust. In order to maintain the

committed level of securitized assets, cash collections on the securitized receivables were used by the Trust to purchase new credit card balances from us in

accordance with the terms of the Credit Card Facility.

We held Retained Interests represented by the Class B Certificate ($23.8 million face value), the Class C Certificate ($68.2 million face value) and the

Seller's Certificate (representing the excess of the total receivables sold to the Trust over the Sold Interests and the Class B and Class C Certificates). In

addition, we held rights to certain residual cash flows comprised of excess finance charge collections (IO Strip). Pursuant to the terms of the Trust, our rights

to payments with respect to the Class B

F-16