Neiman Marcus 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

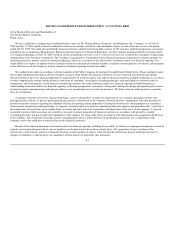

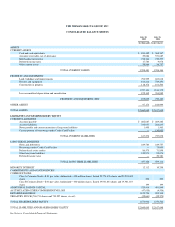

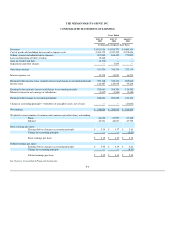

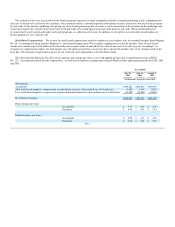

THE NEIMAN MARCUS GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands)

CASH FLOWS—OPERATING ACTIVITIES

Net earnings $ 248,824 $ 204,832 $ 109,303

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation 107,687 99,042 82,878

Deferred income taxes (15,105) 23,274 7,444

Loss on disposition of Chef's Catalog 15,348 — —

Gain on Credit Card Sale (6,170) — —

Net cash received from Credit Card Sale 533,656 — —

Impairment of intangible assets and other charges — 3,853 14,801

Minority interest 3,837 3,549 2,488

Other—primarily costs related to defined benefit pension and other long-term benefit plans 41,633 33,222 24,189

929,710 367,772 241,103

Changes in operating assets and liabilities:

Increase in accounts receivable (71,082) (529,092) (2,817)

Decrease (increase) in undivided interests — 242,565 (33,963)

Increase in merchandise inventories (38,074) (33,215) (30,218)

(Increase) decrease in other current assets (6,161) 12,026 (22,135)

Decrease (increase) in other assets 10,743 (4,454) (10,735)

Increase in accounts payable and accrued liabilities 24,864 40,414 17,770

Increase in deferred real estate credits 15,400 1,556 36,407

Funding of defined benefit pension plan (20,000) (45,000) (30,760)

Net cash provided by operating activities 845,400 52,572 164,652

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (202,535) (120,473) (129,568)

Net increase in cash restricted for repayment of borrowings under Credit Card Facility (40,713) — —

Proceeds from sale of Chef's Catalog and other assets 14,419 3,183 —

Net cash used for investing activities (228,829) (117,290) (129,568)

CASH FLOWS—FINANCING ACTIVITIES

Proceeds from borrowings 10,000 2,750 81,051

Repayment of debt (10,113) (1,500) (81,051)

Borrowings under Credit Card Facility — 225,000 —

Repayment of borrowings under Credit Card Facility (112,500) — —

Acquisition of treasury stock (3,088) (7,553) (15,020)

Cash dividends paid (27,398) (12,632) —

Distributions paid (4,457) (3,727) (2,432)

Proceeds from exercises of stock options and restricted stock grants 16,100 23,797 10,680

Net cash (used for) provided by financing activities (131,456) 226,135 (6,772)

CASH AND CASH EQUIVALENTS

Increase during the year 485,115 161,417 28,312

Beginning balance 368,367 206,950 178,638

Ending balance $ 853,482 $ 368,367 $ 206,950

Supplemental Schedule of Cash Flow Information:

Cash paid during the year for:

Interest $ 22,717 $ 17,833 $ 18,071

Income taxes $ 144,626 $ 104,742 $ 61,860

Noncash activities: