Neiman Marcus 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

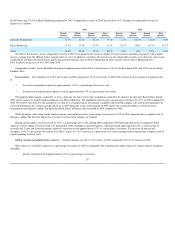

Net cash used for investing activities was $228.8 million in 2005 compared to $117.3 million in 2004. The increase in cash used for investing activities

in 2005 was primarily due to a higher level of capital expenditures in 2005 and $40.7 million of cash restricted in 2005 for the repayment of the outstanding

indebtedness on our Credit Card Facility, partly offset by $14.4 million of proceeds from the sale of Chef's Catalog in November 2004.

Capital expenditures were $202.5 million in 2005 and $120.5 million in 2004. We incurred capital expenditures in 2005 related to the ongoing

construction of new stores in San Antonio and Boca Raton and the remodels of our San Francisco, Houston, Beverly Hills, Newport Beach and Bergdorf

Goodman stores. We opened our San Antonio store in September 2005 and expect to open our Boca Raton store in November 2005. We completed the

renovation of our store in Newport Beach in the third quarter of 2005 and the Beverly Hills store in the fourth quarter of 2005. We currently project capital

expenditures for 2006 to be approximately $160 million to $170 million primarily for new store construction, store renovations and upgrades to information

systems, including warehousing and distribution systems and a new human capital management system. In support of our store construction and renovations,

we expect to receive construction allowances of $20 million to $30 million in 2006. We are currently continuing the remodeling of our San Francisco and

Houston stores as well as the main Bergdorf Goodman store. We expect to complete the expansion and renovation of the San Francisco and Houston stores in

the spring of 2006.

Net cash used for financing activities was $131.5 million in 2005. Net cash provided by financing activities was $226.1 million in 2004. In 2005, we

repaid $112.5 million of borrowings under our Credit Card Facility and paid dividends of $27.4 million. In 2004, we recorded $225.0 million of borrowings

under the Credit Card Facility as a consequence of the discontinuance of Off-Balance Sheet Accounting and incurred no borrowings on our Credit Agreement.

In addition, we repurchased approximately $7.6 million of our stock pursuant to our stock repurchase program and paid dividends of $12.6 million in 2004.

Financing Structure at July 30, 2005

Our major sources of funds are comprised of vendor financing, a $350 million revolving credit agreement, $125 million senior notes, $125 million senior

unsecured debentures and operating leases.

Effective June 9, 2004, we entered into a five-year unsecured revolving credit agreement (the Credit Agreement) with a group of seventeen banks that

provides for borrowings of up to $350 million. At July 30, 2005, we had no borrowings outstanding under the Credit Agreement.

We have two types of borrowing options under the Credit Agreement, a "committed" borrowing and a "competitive bid" borrowing. The rate of interest

payable under a "committed" borrowing is based on one of two pricing options selected by the Company, the level of outstanding borrowings and the rating of

our senior unsecured long-term debt by Moody's and Standard & Poor's. The pricing options available to us under a "committed" borrowing are based on

either LIBOR plus 0.40% to 1.50% or a "base" rate. The base rate is determined based on the higher of the Prime Rate or the Federal Funds Rate plus 0.50%

and a "base" rate margin of up to 0.50%. The rate of interest payable under a "competitive bid" borrowing is based on one of two pricing options that we

select. The pricing options are based on either LIBOR plus a competitive bid margin or an absolute rate, both determined in the competitive auction process.

The Credit Agreement contains covenants that require us, among other things, to maintain certain leverage and fixed charge ratios. The Credit

Agreement also places restrictions on the Company related to 1) the incurrence of liens on our assets and indebtedness by our subsidiaries, 2) sales,

consolidations and mergers, 3) transactions with affiliates and 4) certain common stock repurchase transactions. In addition, the Credit Agreement provides

for 1) acceleration of amounts due, including the nonpayment of amounts due pursuant to the Credit Agreement on a timely basis and the acceleration of other

33