Neiman Marcus 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

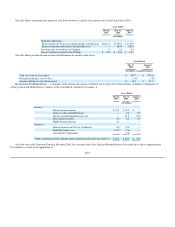

Accounts Receivable. Accounts receivable primarily consist of our third-party credit card receivables and the net trade receivables of the Brand

Development Companies. Prior to the sale of our proprietary credit card accounts to HSBC Bank Nevada National Association (HSBC) on July 7, 2005

(Credit Card Sale), accounts receivable also included our proprietary credit card receivables. Historically, we extended credit to certain of our customers

pursuant to our proprietary retail credit card program. Prior to the Credit Card Sale, our credit operations generated finance charge income, which was

recognized as income when earned and was recorded as a reduction of selling, general and administrative expenses, and we maintained reserves for potential

credit losses. We evaluated the collectibility of our accounts receivable based on a combination of factors, including analysis of historical trends, aging of

accounts receivable, write-off experience and expectations of future performance. Following the Credit Card Sale, HSBC will extend credit to customers

under our proprietary credit card arrangements.

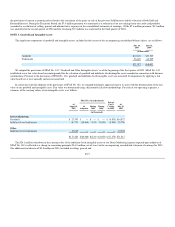

Merchandise Inventories and Cost Of Goods Sold. We utilize the retail method of accounting for substantially all of our merchandise inventories.

Merchandise inventories are stated at the lower of cost or market. The retail inventory method is widely used in the retail industry due to its practicality.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are determined by applying a calculated cost-to-

retail ratio, for various groupings of similar items, to the retail value of inventories. The cost of the inventory reflected on the consolidated balance sheets is

decreased by charges to cost of goods sold at the time the retail value of the inventory is lowered through the use of markdowns. Earnings are negatively

impacted when merchandise is marked down.

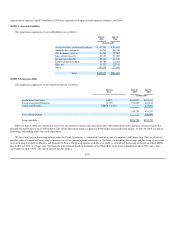

Our sales activities are conducted during two primary selling seasons—Fall and Spring. The Fall selling season is conducted primarily in our first and

second quarters and the Spring selling season is conducted primarily in the third and fourth quarters. During each season, we record markdowns to reduce the

retail value of our inventories. Factors considered in determining markdowns include current and anticipated demand, customer preferences, age of

merchandise and fashion trends. During the season, we record both temporary and permanent markdowns. Temporary markdowns are recorded at the time of

sale and reduce the retail value of only the goods sold. Permanent markdowns are designated primarily for clearance activity and reduce the retail value of all

goods subject to markdown that are held. At the end of each selling season, we record permanent markdowns for clearance goods remaining in ending

inventory.

The areas requiring significant judgment related to the valuation of our inventories include 1) setting the original retail value for the merchandise held for

sale, 2) recognizing merchandise for which the customer's perception of value has declined and appropriately marking the retail value of the merchandise

down to the perceived value and 3) estimating the shrinkage that has occurred between physical inventory counts. These judgments and estimates, coupled

with the averaging processes within the retail method can, under certain circumstances, produce varying financial results. Factors that can lead to different

financial results include 1) determination of original retail values for merchandise held for sale, 2) identification of declines in perceived value of inventories

and processing the appropriate retail value markdowns and 3) overly optimistic or conservative estimates of shrinkage. We believe appropriate merchandise

valuation and pricing controls minimize the risk that our inventory values would be materially misstated.

F-10