Neiman Marcus 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

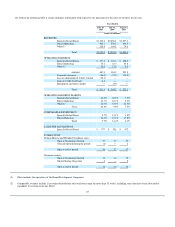

primarily the result of increased revenues, reduced markdowns and net decreases in both buying and occupancy expenses and SG&A expenses as percentages

of revenues.

Operating earnings for Direct Marketing increased to $61.3 million in 2004 from $45.8 million for the prior year period, primarily as a result of increased

revenues and net decreases in both buying and occupancy costs and SG&A expenses as a percentage of revenues offset, in part, by slightly higher markdowns.

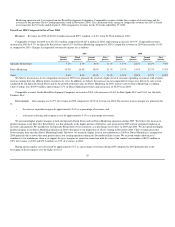

Interest expense, net. Net interest expense was $15.9 million in 2004 and $16.3 million in the prior year. The decrease in net interest expense was

primarily due to increases in both capitalized interest charges associated with store construction and remodeling activities and higher interest income.

The decrease in net interest expense was offset, in part, by an increase in the interest expense attributable to the monthly interest distributions to the

holders of the Sold Interests that began to be charged to interest expense in December 2003 as a result of the discontinuance of Off-Balance Sheet

Accounting.

As a result of a higher level of cash generated by operations, we incurred no borrowings on our revolving credit facility to fund seasonal working capital

requirements in 2004. Seasonal borrowings under our revolving credit facility reached $80 million in the second quarter of 2003 and were repaid prior to the

end of the quarter.

Income taxes. Our effective income tax rate was 36.7% for 2004 and 38.5% for 2003. In the second quarter of 2004, we recognized a net income tax

benefit of $7.5 million related to favorable settlements associated with previous state tax filings. Excluding this benefit, our effective tax rate was 39.0% for

2004 as compared to 38.5% for 2003. This increase in our effective tax rate was primarily due to higher state income taxes.

Inflation and Deflation

We believe changes in revenues and net earnings that have resulted from inflation or deflation have not been material during the periods presented. In

recent years, we have experienced certain inflationary conditions in our cost base due primarily to 1) changes in foreign currency exchange rates that have

reduced the purchasing power of the U.S. dollar and 2) increases in SG&A, particularly with regard to employee benefits.

We purchase a substantial portion of our inventory from foreign suppliers whose costs are affected by the fluctuation of their local currency against the

dollar or who price their merchandise in currencies other than the dollar. Accordingly, changes in the value of the dollar relative to foreign currencies may

increase our cost of goods sold and if we are unable to pass such cost increases to our customers, our gross margins, and ultimately our earnings, would

decrease. Fluctuations in the euro-U.S. dollar exchange rate affect us most significantly; however, we source goods from numerous countries and thus are

affected by changes in numerous currencies and, generally, by fluctuations in the U.S. dollar relative to such currencies. Although we hedge some exposures

to changes in foreign currency exchange rates arising in the ordinary course of business, foreign currency fluctuations could have a material adverse effect on

our business, financial condition and results of operations in the future.

We attempt to offset the effects of inflation through control of expenses and price increases, although our ability to increase prices may be limited by

competitive factors. We attempt to offset the effects of merchandise deflation, which has occurred on a limited basis in recent years, through control of

expenses. There is no assurance, however, that inflation or deflation will not materially affect our operations in the future.

31