Neiman Marcus 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

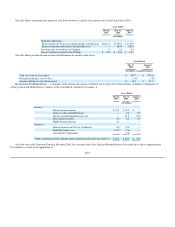

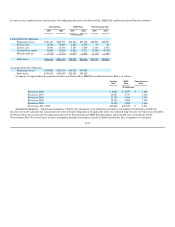

NOTE 6. Common Shareholders' Equity

Authorized Capital. On September 15, 1999, our shareholders approved a proposal to amend our Restated Certificate of Incorporation to increase our

authorized capital to 250 million shares of common stock consisting of 100 million shares of Class A Common Stock, 100 million shares of Class B Common

Stock, 50 million shares of a new Class C Common Stock (having one-tenth [1/10] of one vote per share) and 50 million shares of preferred stock.

Common Stock. Common stock is entitled to dividends if and when declared by the Board of Directors and each share of Class A and Class B

Common Stock outstanding carries one vote. Holders of Class A Common Stock have the right to elect up to 18% of the Board of Directors and holders of

Class B Common Stock have the right to elect at least 82% of the Board of Directors. The Class A Common Stock and Class B Common Stock are identical

in all other respects. Holders of common stock have no cumulative voting, conversion, redemption or preemptive rights.

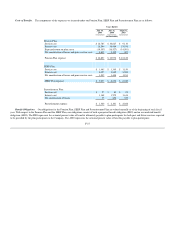

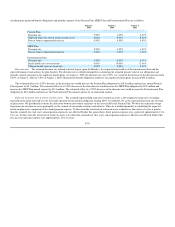

Cash dividend program. In the second quarter of 2005, our Board of Directors increased our quarterly cash dividend from $0.13 per share to $0.15 per

share. In 2005, we declared dividends aggregating $28.4 million, of which dividends payable of $7.3 million were included in accrued liabilities in the

accompanying consolidated balance sheet as of July 30, 2005 and were paid in August 2005.

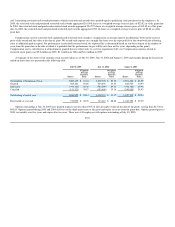

Stock Repurchase Program. In prior years, our Board of Directors authorized various stock repurchase programs and increases in the number of shares

subject to repurchase. In 2005, we repurchased 58,504 shares at an average price of $52.74. In 2004, we repurchased 175,600 shares at an average purchase

price of $40.01 during the first quarter and 10,450 shares at an average price of $50.48 during the fourth quarter. As of July 30, 2005, approximately

1.2 million shares remain available for repurchase under our stock repurchase programs.

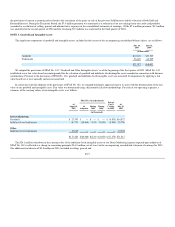

Shareholder Rights Plan. In October 1999, we adopted a shareholder rights plan designed to ensure that our shareholders receive fair and equal

treatment in the event of any proposed takeover of the Company and to guard against partial tender offers and other abusive takeover tactics to gain control of

the Company without paying all shareholders a fair price. The rights plan was not adopted in response to any specific takeover proposal.

Under the rights plan, one right (Right) is attached to each share of The Neiman Marcus Group, Inc. Class A, Class B and Class C Common Stock. Each

Right will entitle the holder to purchase one one-thousandth of a share of a corresponding series of participating preferred stock, with a par value of $.01 per

share, at an exercise price of $100.00 per one one-thousandth of a share of such series. The Rights are not currently exercisable and will become exercisable

only in the event a person or group acquires beneficial ownership of 15% or more of the shares of Class B Common Stock or 15% or more of total number of

shares of Common Stock outstanding. The Rights expire on October 6, 2009 if not earlier redeemed or exchanged.

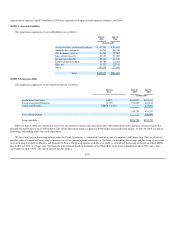

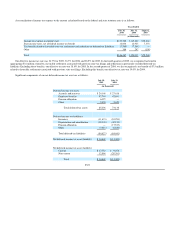

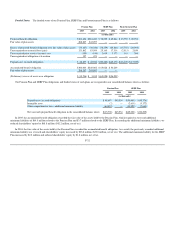

Common Stock Incentive Plans. We have established common stock incentive plans allowing for the granting of 1) stock options, 2) stock

appreciation rights, 3) restricted stock and stock units (restricted stock awards) and 4) other stock-based awards to our employees. At July 30, 2005, there

were 1.1 million shares of common stock available for grant under our common stock incentive plans.

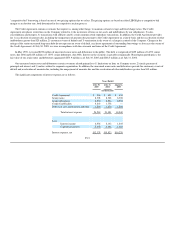

In 2005, 2004 and 2003, we made stock-based awards in the form of 1) restricted stock awards for which there was no exercise price payable by the

employee, 2) purchased restricted stock awards for which the exercise price was equal to 50% of the fair value of our common stock on the date of grant

F-22