Neiman Marcus 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

Our cash requirements consist principally of:

the funding of our merchandise purchases;

capital expenditures for new store construction, store renovations and upgrades of our management information systems;

debt service requirements;

income tax payments; and

obligations related to our Pension Plan.

Our working capital requirements fluctuate during the year, increasing substantially during the first and second quarters of each fiscal year as a result of

higher seasonal levels of working capital.

We have typically financed the increases in working capital needs during the first and second fiscal quarters with cash flows from operations and cash

provided from borrowings under our credit facilities. Following the closing of the Transactions, we expect to finance future seasonal increases in working

capital needs with cash flows from operations and borrowings under our new senior secured asset-based revolving credit facility.

Historically, our primary sources of short-term liquidity were comprised of cash on hand and availability under our revolving credit facility. The amount

of cash on hand and borrowings under the revolving credit facility were influenced by a number of factors, including revenues, working capital levels, vendor

terms, the level of capital expenditures, cash requirements related to financing instruments, Pension Plan funding obligations and tax payment obligations,

among others. Following the closing of the Transactions, we expect that our primary sources of short-term liquidity will be cash on hand and availability

under our new senior secured asset-based revolving credit facility. We expect that the amount of cash on hand and borrowings under such new senior secured

asset-based revolving credit facility will continue to be influenced by the factors described above and, in addition, the additional debt service obligations to

which we will be subject following the Transactions.

We believe that operating cash flows, currently available vendor financing and amounts available pursuant to our revolving credit facility should be

sufficient to fund our operations and debt service requirements, including Pension Plan funding requirements, contractual obligations and commitments and

currently anticipated capital expenditure requirements, through the closing date of the Transactions. Following the closing of the Transactions, we expect that

operating cash flows, available vendor financing and amounts available pursuant to our new senior secured asset-based revolving credit facility should be

sufficient to fund our operations and debt service requirements, including Pension Plan funding requirements, contractual obligations and commitments,

anticipated capital expenditure requirements and our additional debt service obligations, through the end of 2006.

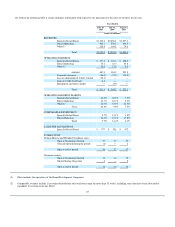

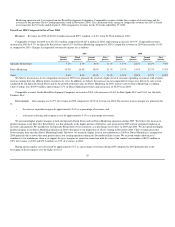

We generated cash from operations, prior to changes in operating assets and liabilities, of $929.7 million in 2005 compared to $367.8 million in 2004.

This $561.9 million increase in cash generated from operations was primarily due to the net cash received from the Credit Card Sale of $533.7 million and

higher sales and earnings levels realized in 2005. Net cash provided by operating activities was $845.4 million in 2005 and $52.6 million in 2004. In 2004, the

cash generated from operations was reduced by the increase in accounts receivable, including our undivided interests in the NMG Credit Card Master Trust,

from $265.7 million at August 2, 2003 to $551.7 million at July 31, 2004. This increase in accounts receivable is attributable both to a higher investment in

accounts receivable due to higher revenues during 2004 and the discontinuance of Off-Balance Sheet Accounting beginning in December 2003, as more fully

described in Note 2 of the Notes to Consolidated Financial Statements.

32

•

•

•

•

•