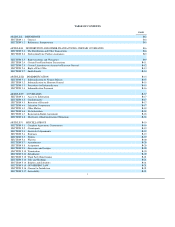

Neiman Marcus 2004 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(ix) Harcourt General agrees to vote, or cause to be voted, all shares of Neiman Marcus Common Stock owned by it in favor of the adoption

of the Recapitalization Agreement, the Governance Amendments and the Authorized Capital Amendment.

(x) Harcourt General and Neiman Marcus shall enter into an Amended and Restated Intercompany Services Agreement, pursuant to which

Harcourt General will continue to provide corporate services to Neiman Marcus.

(xi) Except as set forth above in clause (x), all agreements and arrangements existing on the date hereof between Harcourt General or any of

its Subsidiaries on the one hand and Neiman Marcus and any of its Subsidiaries on the other hand, whether written or oral, shall continue in full

force and effect in accordance with their terms and consistent with past practice from the date hereof, through the Distribution Date and thereafter.

SECTION 2.2 Declaration Date; Further Assurances. (a) The parties agree that the Declaration Date shall occur as soon as reasonably practicable

following the satisfaction or waiver of the conditions to the declaration of the Distribution set forth in Section 2.1(b). To the extent any action of the Board of

Directors of Neiman Marcus or Harcourt General is necessary to consummate the Distribution, the parties shall cause their respective Boards of Directors to

meet telephonically or at the same location on the Declaration Date and each shall take such corporate action at such meeting as shall be required to effect the

transactions contemplated hereby and by the Recapitalization Agreement. Immediately following such meetings, Neiman Marcus shall take all actions

required to consummate the Recapitalization in accordance with the terms of the Recapitalization Agreement, including the filing of the certificate of merger

relating to the Recapitalization with the Secretary of State of the State of Delaware.

(b) Subject to Harcourt General's right to terminate this Agreement in accordance with Section 5.10, in case at any time after the date hereof any

further action is reasonably necessary or desirable to carry out the Recapitalization or Distribution or any other purpose of this Agreement or the

Recapitalization Agreement, the proper officers of each party to this Agreement shall take all such necessary action, and shall execute and deliver all

necessary instruments related thereto. Without limiting the foregoing, and subject as aforesaid, Harcourt General and Neiman Marcus shall use their

respective reasonable best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things, reasonably necessary, proper or

advisable under applicable laws, regulations and agreements or otherwise to consummate and make effective the transactions contemplated by this

Agreement, including, without limitation, promptly to obtain all consents and approvals, to enter into all amendatory agreements (including, without

limitation, agreeing to such other amendments or modifications of this Agreement in order to obtain the IRS Ruling), to make all filings and applications

that may be required for the consummation of the transactions contemplated by this Agreement and the Recapitalization Agreement, including all

applicable governmental and regulatory filings, and to permit each other to review and comment on all correspondence and filings related to the

foregoing.

SECTION 2.3 Representations and Warranties. (a) Neiman Marcus hereby represents and warrants to Harcourt General as follows:

(i) Organization; Good Standing. Neiman Marcus is a corporation duly incorporated, validly existing and in good standing under the laws of the

State of Delaware and has all corporate power required to consummate the transactions contemplated hereby and by the Recapitalization Agreement.

(ii) Authorization. The execution, delivery and performance by Neiman Marcus of this Agreement and the Recapitalization Agreement and the

consummation by Neiman Marcus of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate

B-9