Neiman Marcus 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

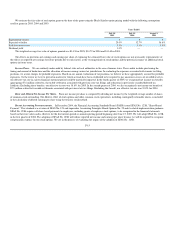

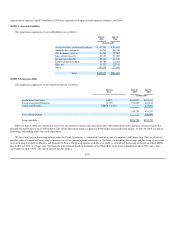

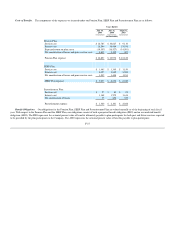

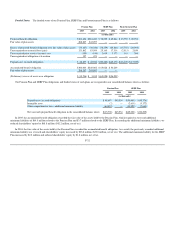

A reconciliation of income tax expense to the amount calculated based on the federal and state statutory rates is as follows:

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands)

Income tax expense at statutory rate $139,702 $115,260 $72,044

State income taxes, net of federal income tax benefit 14,006 12,925 7,354

Tax benefit related to favorable state tax settlements and reductions in deferred tax liabilities (7,585) (7,500) —

Other 364 247 (150)

Total $146,487 $120,932 $79,248

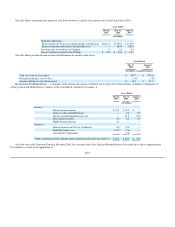

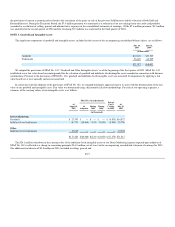

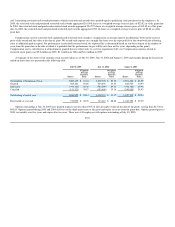

Our effective income tax rate was 36.7% for 2005, 36.7% for 2004 and 38.5% for 2003. In the fourth quarter of 2005, we recognized tax benefits

aggregating $7.6 million related to a favorable settlement associated with previous state tax filings and reductions in previously recorded deferred tax

liabilities. Excluding these benefits, our effective tax rate was 38.6% for 2005. In the second quarter of 2004, we also recognized a tax benefit of $7.5 million

related to favorable settlements associated with previous state tax filings. Excluding this benefit, our effective tax rate was 39.0% for 2004.

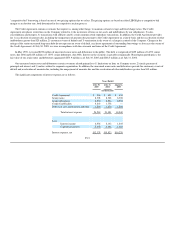

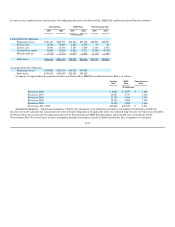

Significant components of our net deferred income tax asset are as follows:

July 30,

2005

July 31,

2004

(in thousands)

Deferred income tax assets:

Accruals and reserves $ 24,140 $ 27,618

Employee benefits 52,794 42,891

Pension obligation 6,327 —

Other 2,035 2,629

Total deferred tax assets 85,296 73,138

Deferred income tax liabilities:

Inventory (11,674) (10,951)

Depreciation and amortization (39,343) (49,133)

Pension obligation — (17,517)

Other (3,610) (6,840)

Total deferred tax liabilities (54,627) (84,441)

Net deferred income tax asset (liability) $ 30,669 $(11,303)

Net deferred income tax asset (liability):

Current $ 17,783 $ 9,078

Non-current 12,886 (20,381)

Total $ 30,669 $(11,303)

F-25