Neiman Marcus 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

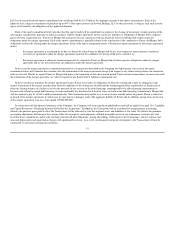

Products, LLC, which designs and markets the Laura Mercier cosmetics line. Our investments in and relationships with our Brand Development Companies

are governed by operating agreements that provide for an orderly transition process in the event any investor wishes to sell its interest, or purchase another

investor's interest. Among other things, these operating agreements contain currently exercisable put option provisions entitling each minority investor to put

their interest to us, and currently exercisable call option provisions entitling us to purchase each minority investor's interest, at a purchase price mutually

agreed to by the parties. The purchase price will be determined, in the case of the Gurwitch interests, by one or more nationally recognized investment

banking firms and, in the case of the Kate Spade interests, by the parties or, in the event the parties are unable to agree on a mutually acceptable price, by a

mutually acceptable nationally recognized investment banking firm, subject to certain conditions. We may elect, in certain circumstances, to defer the

consummation of a put option for a period of six months by cooperating with the other investors in seeking either a sale of the Brand Development Company

to a third party or a public offering of the Brand Development Company's securities. If a sale to a third party or public offering of the Brand Development

Company's securities is not consummated within six months after the exercise of the put option (which period may be automatically extended for an

additional two months if a registration statement for the Brand Development Company is filed with the Securities and Exchange Commission), we are

obligated to consummate the put option. Under the terms of the Kate Spade operating agreement, such consummation shall occur within thirty days after the

determination of the valuation with respect to the exercise of the put option.

Recently, we have been in extensive discussions with the minority investors of Kate Spade LLC regarding certain strategic alternatives, including the

possible sale of such company. However, while such discussions are ongoing, no assurance can be given that they will ultimately lead to any transaction.

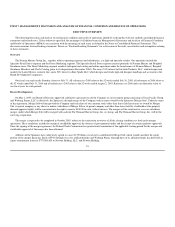

The Transactions

On May 1, 2005, our Board of Directors approved a definitive agreement to sell the Company to an investment group consisting of Texas Pacific Group

and Warburg Pincus, LLC (collectively, the Sponsors), through a merger of the Company with an entity owned by the Sponsors. Under the terms of this

agreement, Newton Acquisition Merger Sub, Inc. (Merger Sub) will merge with the Company and each share of the Company's common stock (other than

shares held in treasury or owned by Newton Acquisition Merger Sub, Inc., its parent company or any direct or indirect subsidiary of Newton Acquisition

Merger Sub, Inc. or its parent company and other than shares held by stockholders who properly demand appraisal rights) will be converted into the right to

receive $100.00 in cash, without interest. The merger will be structured as a reverse subsidiary merger, under which Newton Acquisition Merger Sub, Inc.

will be merged with and into The Neiman Marcus Group, Inc. at closing, and The Neiman Marcus Group, Inc. will be the surviving corporation.

The merger is expected to be completed in October 2005, subject to the satisfaction or waiver of all the closing conditions set forth in the merger

agreement. These conditions include the receipt of stockholder approval, the absence of governmental orders and the receipt of certain regulatory approvals.

Since the signing of the merger agreement, the Federal Trade Commission has granted early termination of the applicable waiting period for the merger and

stockholder approval of the merger has been obtained.

In connection with the merger, we will incur significant indebtedness and will be highly leveraged. See Item 7. "Management's Discussion and Analysis

of Financial Condition and Results of Operations—Liquidity and Capital Resources—Financing Structure Related to the Transactions."

11