Neiman Marcus 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

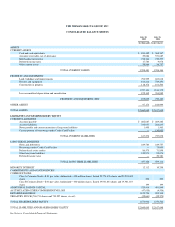

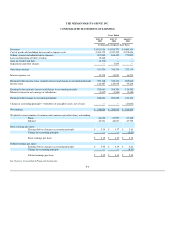

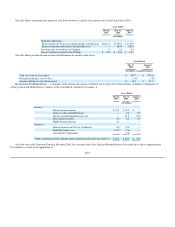

THE NEIMAN MARCUS GROUP, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Common

Stocks

Accumulated

Other

Comprehensive

Income (Loss)

Class

A

Class

B

Additional

Paid-In

Capital

Retained

Earnings

Treasury

Stock

Total

Shareholders'

Equity

(in thousands)

BALANCE AT AUGUST 3, 2002 $280 $200 $443,788 $ 906 $ 610,139 $ — $ 1,055,313

Issuance of 482 shares for stock based compensation awards 5 — 10,675 — — — 10,680

Acquisition of treasury stock (15,020) (15,020)

Other equity transactions (3) (3) 4,057 — — — 4,051

Comprehensive income:

Net earnings — — — — 109,303 — 109,303

Adjustments for fluctuations in fair market value of financial instruments, net

of tax $466 744 744

Reclassification of amounts to net earnings, net of tax of ($562) — — — (916) — — (916)

Minimum pension liability, net of tax of ($16,744) — — — (26,744) — — (26,744)

Other — — — 437 — — 437

Total comprehensive income — — — — — — 82,824

BALANCE AT AUGUST 2, 2003 282 197 458,520 (25,573) 719,442 (15,020) 1,137,848

Issuance of 950 shares for stock based compensation awards 10 — 23,787 — — — 23,797

Acquisition of treasury stock — — — — — (7,553) (7,553)

Cash dividends declared ($0.39 per share) — — — — (18,944) — (18,944)

Other equity transactions 1 2 9,542 — — — 9,545

Comprehensive income:

Net earnings — — — — 204,832 — 204,832

Adjustments for fluctuations in fair market value of financial instruments, net

of tax ($349) (546) (546)

Reclassification of amounts to net earnings, net of tax of ($466) — — — (744) — — (744)

Minimum pension liability, net of tax of $13,755 — — — 22,071 — — 22,071

Other — — — 256 — — 256

Total comprehensive income — 225,869

BALANCE AT JULY 31, 2004 293 199 491,849 (4,536) 905,330 (22,573) 1,370,562

Issuance of 491 shares for stock based compensation awards 5 — 16,095 — — — 16,100

Acquisition of treasury stock — — — — — (3,088) (3,088)

Cash dividends declared ($0.58 per share) — — — — (28,428) — (28,428)

Other equity transactions — — 12,470 — — — 12,470

Comprehensive income:

Net earnings — — — — 248,824 — 248,824

Adjustments for fluctuations in fair market value of financial instruments, net

of tax ($706) (1,114) (1,114)

Reclassification of amounts to net earnings, net of tax of $349 — — — 546 — — 546

Minimum pension liability, net of tax of ($26,511) — — — (42,248) — — (42,248)

Other — — — 322 — — 322

Total comprehensive income — 206,330

BALANCE AT JULY 30, 2005 $298 $199 $520,414 $ (47,030) $1,125,726 $(25,661) $ 1,573,946

See Notes to Consolidated Financial Statements.

F-8