Neiman Marcus 2004 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

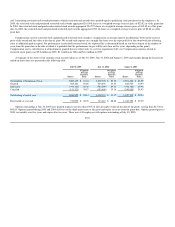

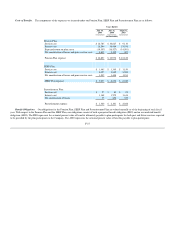

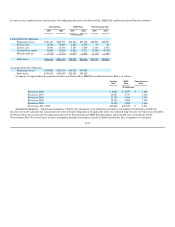

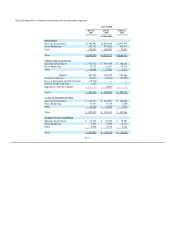

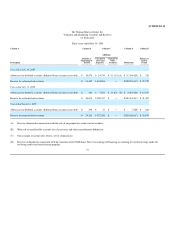

Funded Status. The funded status of our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Pension Plan SERP Plan Postretirement Plan

2005 2004 2005 2004 2005 2004

(in thousands)

Projected benefit obligation $361,434 $281,423 $ 78,259 $ 65,864 $ 15,755 $ 20,994

Fair value of plan assets 288,267 243,097 — — — —

Excess of projected benefit obligation over fair value of plan assets (73,167) (38,326) (78,259) (65,864) (15,755) (20,994)

Unrecognized net actuarial loss (gain) 121,862 83,599 25,160 17,316 (2,515) 2,859

Unrecognized prior service (income) cost (155) (190) 2,619 3,172 161 206

Unrecognized net obligation at transition 157 471 — — — —

Prepaid asset (accrued obligation) $ 48,697 $ 45,554 $(50,480) $(45,376) $(18,109) $(17,929)

Accumulated benefit obligation $304,063 $240,082 $ 65,028 $ 56,209

Fair value of plan assets 288,267 243,097 — —

(Deficiency) excess of assets over obligation $ (15,796) $ 3,015 $(65,028) $(56,209)

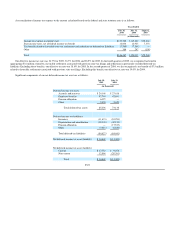

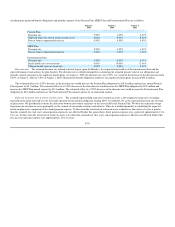

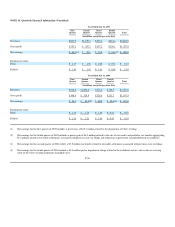

Our Pension Plan and SERP Plan obligations and funded status of such plans are recognized in our consolidated balance sheets as follows:

Pension Plan SERP Plan

2005 2004 2005 2004

(in thousands)

Prepaid asset (accrued obligation) $ 48,697 $45,554 $(50,480) $(45,376)

Intangible asset (2) — (2,619) (3,172)

Other comprehensive loss—additional minimum liability (64,491) — (11,929) (7,661)

Net (accrued) prepaid benefit obligation in the consolidated balance sheets $(15,796) $45,554 $(65,028) $(56,209)

In 2005, the accumulated benefit obligation exceeded the fair value of the assets held by the Pension Plan, which required us to record additional

minimum liabilities of $64.5 million related to the Pension Plan and $3.7 million related to the SERP Plan. In recording the additional minimum liabilities, we

reduced shareholders' equity by $68.8 million ($42.2 million, net of tax).

In 2004, the fair value of the assets held by the Pension Plan exceeded the accumulated benefit obligation. As a result, the previously recorded additional

minimum liability was reversed and shareholders' equity increased by $38.8 million ($23.8 million, net of tax). The additional minimum liability for the SERP

Plan increased by $2.2 million and reduced shareholders' equity by $1.8 million, net of tax.

F-32