Neiman Marcus 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

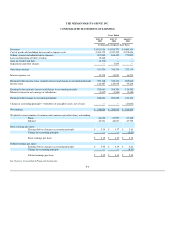

THE NEIMAN MARCUS GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. Summary of Significant Accounting Policies

BASIS OF PRESENTATION

The Consolidated Financial Statements of The Neiman Marcus Group, Inc. and subsidiaries (Company) have been prepared in accordance with generally

accepted accounting principles. Our businesses consist of Specialty Retail Stores (Specialty Retail Stores), primarily Neiman Marcus Stores and Bergdorf

Goodman, and Neiman Marcus Direct, our direct marketing operation (Direct Marketing).

We own a 51% interest in Gurwitch Products, LLC, which distributes and markets the Laura Mercier cosmetic line, and a 56% interest in Kate Spade

LLC, a manufacturer and retailer of high-end designer handbags and accessories (the Brand Development Companies). All significant intercompany accounts

and transactions have been eliminated.

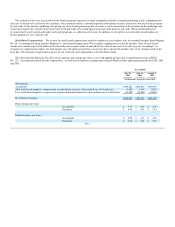

Our fiscal year ends on the Saturday closest to July 31. All references to 2005 relate to the 52 weeks ended July 30, 2005; all references to 2004 relate to

the 52 weeks ended July 31, 2004 and all references to 2003 relate to the 52 weeks ended August 2, 2003. References to 2006 and years thereafter relate to

our fiscal years for such periods.

On May 1, 2005, our Board of Directors approved a definitive agreement to sell the Company to an investment group consisting of Texas Pacific Group

and Warburg Pincus, LLC (collectively, the Sponsors). Under the terms of the agreement, the Sponsors will acquire all of the outstanding Class A and Class B

shares of The Neiman Marcus Group, Inc. for $100.00 per share in cash, representing a transaction value of approximately $5.1 billion. Each of the Sponsors

will own equal stakes in the Company upon completion of the transaction. Our shareholders approved the definitive agreement to sell the Company on

August 16, 2005. The sale is currently anticipated to close in October 2005.

ESTIMATES AND CRITICAL ACCOUNTING POLICIES

We make estimates and assumptions about future events in preparing our financial statements in conformity with generally accepted accounting

principles. These estimates and assumptions affect the amounts of assets, liabilities, revenues and expenses and the disclosure of gain and loss contingencies

at the date of the Consolidated Financial Statements.

While we believe that our past estimates and assumptions have been materially accurate, the amounts currently estimated are subject to change if we

make different assumptions as to the outcome of future events. We evaluate our estimates and judgments on an ongoing basis and predicate those estimates

and judgments on historical experience and on various other factors that we believe to be reasonable under the circumstances. We make adjustments to our

assumptions and judgments when facts and circumstances dictate. Since future events and their effects cannot be determined with absolute certainty, actual

results may differ from the estimates used in preparing the accompanying Consolidated Financial Statements.

Cash and Cash Equivalents. Cash and cash equivalents primarily consist of cash on hand in the stores, deposits with banks and overnight investments

with banks and financial institutions. Cash equivalents are stated at cost, which approximates fair value. Our cash management system provides for the

reimbursement of all major bank disbursement accounts on a daily basis. Accounts payable includes $45.0 million of outstanding checks not yet presented for

payment at July 30, 2005 and $53.5 million at July 31, 2004.

F-9