Neiman Marcus 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

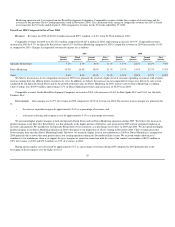

advertising, which decreased approximately 0.3% as a percentage of revenues; and

employee benefits, which decreased approximately 0.1% as a percentage of revenues, as a result of the higher level of revenues in 2004, as well

as the control and containment of variable expenses. In 2004, employee benefit expenses increased by approximately 10% from 2003; however,

such expenses were lower as a percentage of revenues in 2004 due to the higher level of revenues.

In addition, SG&A expenses decreased as a percentage of revenues in 2004 as a result of:

the reduction in preopening costs, which decreased approximately 0.1% as a percentage of revenues; and

a $3.7 million tax benefit, which represented approximately 0.1% of revenues, recorded in the second quarter of 2004 as a result of conclusions

on certain sales tax and unclaimed property examinations for which the agreed-on settlements were less than the amounts we previously

estimated.

We opened no new stores in 2004. In 2003, we incurred preopening expenses of $8.0 million in connection with the opening of two Neiman Marcus

stores in Florida in the first quarter of 2003, the opening of a new clearance center store in the Denver, Colorado area in the second quarter of 2003, the grand

opening of the remodeled and expanded Neiman Marcus store in Las Vegas in the second quarter of 2003 and the opening of another new clearance center in

Miami, Florida in the fourth quarter of 2003.

The decreases in SG&A expenses as a percentage of revenues were partially offset by:

higher costs for incentive compensation, which increased approximately 0.4% as a percentage of revenues in 2004 as a result of the increased

operating profits we generated; and

a decrease in the income from our credit card portfolio of approximately 0.1% as a percentage of revenues.

The net income generated by our credit card portfolio, as a percentage of revenues, declined 0.1% as a percentage of revenues in 2004 compared to the

prior year primarily as a result of 1) a $7.6 million reduction in income, approximately 0.2% as a percentage of revenues, due to the required amortization

during the Transition Period of the premium associated with the carrying value of the Retained and Sold Interests, as more fully described in Note 2 of the

Notes to Consolidated Financial Statements and 2) a decrease in the yield earned on the credit card portfolio attributable to a decrease in the average days the

receivables are outstanding prior to customer payment, which decreased finance charge income by approximately 0.1% as a percentage of revenues. These

reductions in the income from the credit card portfolio were offset, in part, by a lower level of bad debts, which decreased approximately 0.1% as a percentage

of revenues, and a $2.4 million decrease in the required monthly interest distributions to the holders of the Sold Interests in 2004, which decreased

approximately 0.1% as a percentage of revenues. During the period our revolving credit securitization program qualified for Off-Balance Sheet Accounting,

the interest distributions were charged to SG&A expenses. With the transition from Off-Balance Sheet Accounting to Financing Accounting that began in

December 2003, these distributions were charged to interest expense.

Impairment and other charges. In the fourth quarter of 2004, we recorded a $3.9 million pretax impairment charge related to the writedown to fair

value of the net carrying value of the Chef's Catalog tradename intangible asset based upon current and anticipated future revenues associated with the brand.

Segment operating earnings. Operating earnings for the Specialty Retail Stores segment were $310.6 million for 2004 compared to $198.2 million for

the prior year period. This 56.7% increase was

30

•

•

•

•

•

•