Neiman Marcus 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

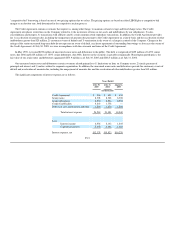

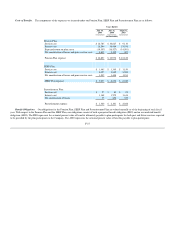

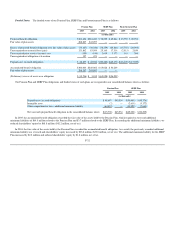

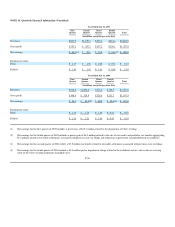

Funding Policy and Plan Assets. Our policy is to fund the Pension Plan at or above the minimum required by law. We made the following

contributions to our Pension Plan:

2005 2004 2003

Voluntary Voluntary Required Voluntary

(in millions)

Plan Year Ended:

July 31, 2005 $ — $ — $ — $ —

July 31, 2004 20.0 15.0 — —

July 31, 2003 — 30.0 5.8 —

July 31, 2002 — — 11.5 13.5

Total $ 20.0 $ 45.0 $ 17.3 $ 13.5

Based upon currently available information, we will not be required to make contributions to the Pension Plan for the plan year ended July 31, 2005.

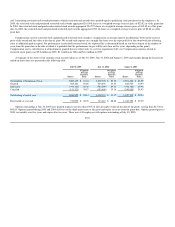

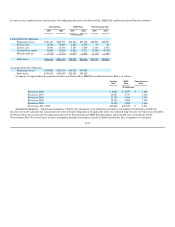

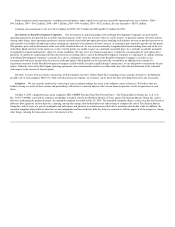

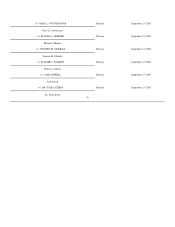

Assets held by the Pension Plan are invested in accordance with the provisions of our approved investment policy. The asset allocation for our Pension

Plan at the end of 2005 and the target allocation for 2006, by asset category, are as follows:

Pension Plan

Allocation

at July 31,

2005

2006

Target

Allocation

Equity Securities 68% 80%

Fixed Income Securities 30% 20%

Cash and Equivalents 2% —

Total 100% 100%

The Pension Plan's strategic asset allocation was structured to reduce volatility through diversification and enhance return to approximate the amounts

and timing of the expected benefit payments.

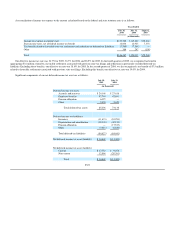

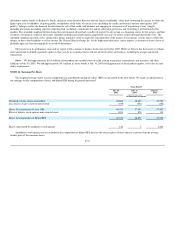

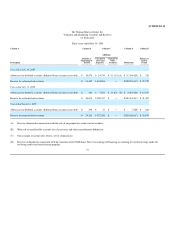

Changes in the assets held by the Pension Plan in 2005 and 2004 are as follows:

2005 2004

(in thousands)

Fair value of assets at beginning of year $243,097 $183,044

Actual return on assets 32,888 22,767

Company contributions 20,000 45,000

Benefits paid (7,718) (7,714)

Fair value of assets at end of year $288,267 $243,097

F-31