Neiman Marcus 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

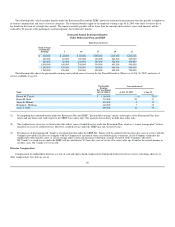

counted more than once because of certain rules and regulations of the SEC. The total number of shares owned by, or for the benefit of, Richard A.

Smith, Nancy L. Marks and members of their families is as shown for the Smith Family Holders. See Note 2 below. Mr. Smith disclaims beneficial

ownership of 2,216,944 shares of Class B common stock held by various family trusts, foundations and companies. Mrs. Marks disclaims beneficial

ownership of 1,622,484 shares of Class B common stock held by various family trusts, foundations and companies.

The Smith Family Holders include Richard A. Smith, Chairman of the Company; Nancy L. Marks, Mr. Smith's sister; Robert A. Smith, Co-Vice

Chairman of the Company, and Brian J. Knez, Co-Vice Chairman of the Company, who are, respectively, the son and son-in-law of Richard A. Smith;

other members of their families; and various family trusts, foundations and companies. The Smith Family Holders possess sole or shared voting power

over all of the shares shown in the table.

In connection with the merger, the Smith Family Holders filed Amendment No. 1 to Schedule 13D with the SEC which discloses that the Smith Family

Holders have entered into the stockholder agreement relating to the merger. See "The Stockholder Agreement."

The information reported with respect to the Class A common stock and Class B common stock is based on a Schedule 13F, dated February 11, 2005,

filed with the SEC by Gabelli Funds, Inc. and its affiliates. Gabelli Funds, Inc. and its affiliates have shared voting power with respect to 26,400 shares

and sole dispositive power with respect to 3,652,460 shares reported in the table.

The information reported with respect to the Class A common stock is based on an Amendment No. 8 to Schedule 13G, dated March 23, 2005, filed

with the SEC by PRIMECAP Management Company. PRIMECAP Management Company has sole dispositive power with respect to all of the shares

reported in the table and sole voting power with respect to 567,139 shares. With respect to Class B common stock, the information reported is based on

Amendment No. 2 to Schedule 13G, dated May 31, 2005, filed with the SEC by PRIMECAP Management Company. PRIMECAP Management

Company has sole voting power with respect to 326,918 shares and sole dispositive power with respect to all shares reported in the table.

The information reported with respect to the Class A common stock is based on Amendment No. 4 to Schedule 13G, dated February 7, 2005, filed with

the SEC by Southeastern Asset Management, Inc. Southeastern Asset Management, Inc. has sole voting power with respect to 1,514,500 shares and

sole dispositive power with respect to all of the shares listed in the table. With respect to Class B common stock, the information reported is based on

Amendment No. 6 to Schedule 13G, dated April 7, 2005, filed with the SEC by Southeastern Asset Management, Inc. Southeastern Asset

Management, Inc. has sole voting and dispositive power with respect to 1,498,000 shares and shared voting and shared dispositive power with respect

to 235,500 shares.

The information reported with respect to the Class A common stock is based on Amendment No. 5 to Schedule 13G, dated February 14, 2005, filed

with the SEC by Vanguard/Primecap Fund. With respect to Class B common stock, the information reported is based on Amendment No. 8 to

Schedule 13G, dated February 14, 2005, filed with the SEC by Vanguard/Primecap Fund Inc. Vanguard/Primecap Fund has sole voting power with

respect to all the shares reported in the table.

The information reported is based on Amendment No. 4 to Schedule 13G, dated February 14, 2005, filed with the SEC by Wellington Management

Company, LLP. Wellington Management Company, LLP has shared voting with respect to 3,017,700 shares and shared dispositive power with respect

to all of the shares reported in the table.

The information reported is based on Amendment No. 2 to Schedule 13G, dated February 10, 2005, filed with the SEC by The Hartford Series

Fund, Inc. The Hartford Series Fund, Inc. has shared voting and shared dispositive power with respect to all the shares reported in the table.

The information reported is based on Schedule 13G, dated May 2, 2005, filed with the SEC by Atticus Capital, L.L.C. Atticus Capital, L.L.C. has sole

voting and sole dispositive power with respect to all the shares reported in the table.

Includes 55,500 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. All of the

shares reported by Mr. Smith are included in the shares owned by

66

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)