Neiman Marcus 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

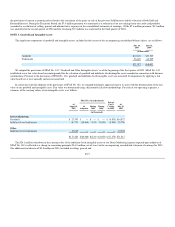

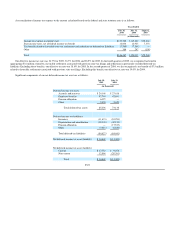

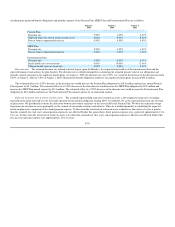

calculating the projected benefit obligations and periodic expense of our Pension Plan, SERP Plan and Postretirement Plan are as follows:

August 1,

2005

August 1,

2004

August 1,

2003

Pension Plan:

Discount rate 5.50% 6.25% 6.50%

Expected long-term rate of return on plan assets 8.00% 8.00% 8.00%

Rate of future compensation increase 4.50% 4.50% 4.50%

SERP Plan:

Discount rate 5.50% 6.25% 6.50%

Rate of future compensation increase 4.50% 4.50% 4.50%

Postretirement Plan:

Discount rate 5.50% 6.25% 6.50%

Initial health care cost trend rate 9.00% 10.00% 11.00%

Ultimate health care cost trend rate 5.00% 5.00% 5.00%

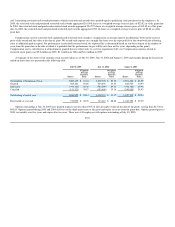

Discount rate. The assumed discount rate utilized is based, in part, upon the Moody's Aa corporate bond yield as of the measurement date and the

expected timing of cash outlays for plan benefits. The discount rate is utilized principally in calculating the actuarial present value of our obligations and

periodic expense pursuant to our employee benefit plans. At August 1, 2005, the discount rate was 5.50%. As a result of the decrease in the discount rate from

6.25% at August 1, 2004 to 5.50% at August 1, 2005, the projected benefit obligations related to our employee benefit plans increased $54.6 million.

The estimated effect of a 0.25% decrease in the discount rate would increase the Pension Plan obligation by $15.0 million and increase annual Pension

Plan expense by $1.7 million. The estimated effect of a 0.25% decrease in the discount rate would increase the SERP Plan obligation by $2.8 million and

increase the SERP Plan annual expense by $0.3 million. The estimated effect of a 0.25% decrease in the discount rate would increase the Postretirement Plan

obligation by $0.4 million and increase the Postretirement Plan annual expense by an immaterial amount.

Expected long-term rate of return on plan assets. The assumed expected long-term rate of return on assets is the weighted average rate of earnings

expected on the funds invested or to be invested to provide for the pension obligation. During 2005, we utilized 8.0% as the expected long-term rate of return

on plan assets. We periodically evaluate the allocation between investment categories of the assets held by the Pension Plan. We base the expected average

long-term rate of return on assets principally on the counsel of our outside actuaries and advisors. This rate is utilized primarily in calculating the expected

return on plan assets component of the annual pension expense. To the extent the actual rate of return on assets realized over the course of a year is greater

than the assumed rate, that year's annual pension expense is not affected. Rather this gain reduces future pension expense over a period of approximately 12 to

18 years. To the extent the actual rate of return on assets is less than the assumed rate, that year's annual pension expense is likewise not affected. Rather this

loss increases pension expense over approximately 12 to 18 years.

F-29