Neiman Marcus 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

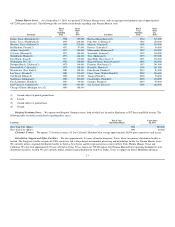

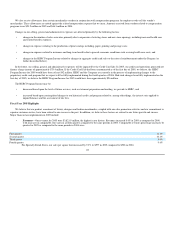

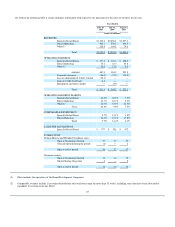

For 2005, net earnings reflect tax benefits aggregating $7.6 million resulting from favorable settlements associated with previous state tax filings and

reductions in previously recorded deferred tax liabilities.

For 2004, operating earnings include a $3.9 million pretax impairment charge related to the writedown to fair value in the net carrying value of the

Chef's Catalog tradename intangible asset.

For 2004, net income reflects a $7.5 million tax benefit related to favorable settlements associated with previous state tax filings.

For 2003, net earnings reflect an after-tax charge of $14.8 million for the writedown of certain intangible assets related to prior purchase business

combinations as a result of the implementation of a new accounting principle.

For 2002, operating earnings reflect 1) a $16.6 million gain from the change in vacation policy made by the Company and 2) $13.2 million of

impairment and other charges, related primarily to the impairment of certain long-lived assets.

For 2001, operating earnings reflect a $9.8 million impairment charge related to our investment in a third-party internet retailer.

Comparable revenues include 1) revenues derived from our retail stores open for more than 52 weeks, including stores that have been relocated or

expanded, 2) revenues from our Direct Marketing operation and 3) revenues from the Brand Development Companies. Comparable revenues exclude

the revenues of closed stores and the revenues of our previous Chef's Catalog operations (sold in November 2004). The calculation of the change in

comparable revenues for 2003 is based on revenues for the 52 weeks ended August 2, 2003 compared to revenues for the 52 weeks ended July 27,

2002.

17

(2)

(3)

(4)

(5)

(6)

(7)

(8)