Neiman Marcus 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

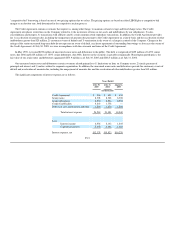

the provisions of current accounting rules related to the calculation of the gains on sale of the previous Sold Interests and the valuation of both Sold and

Retained Interests. During the Transition Period, the $7.6 million premium was amortized as a reduction of our net earnings from our credit card portfolio

(recorded as a reduction of selling, general and administrative expenses in the consolidated statements of earnings). Of the $7.6 million premium, $5.3 million

was amortized in the second quarter of 2004 and the remaining $2.3 million was amortized in the third quarter of 2004.

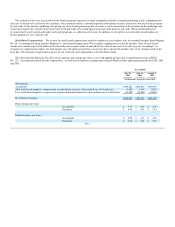

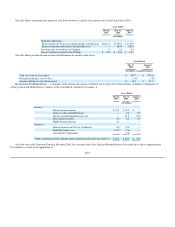

NOTE 3. Goodwill and Intangible Assets

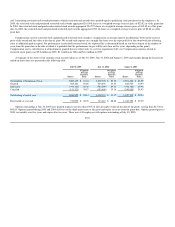

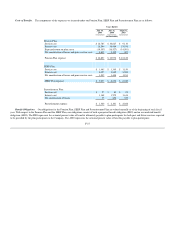

The significant components of goodwill and intangible assets, included in other assets in the accompanying consolidated balance sheets, are as follows:

July 30,

2005

July 31,

2004

(in thousands)

Goodwill $14,872 $23,747

Trademarks 56,645 64,945

$71,517 $88,692

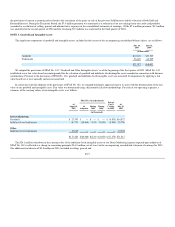

We adopted the provisions of SFAS No. 142, "Goodwill and Other Intangible Assets" as of the beginning of the first quarter of 2003. SFAS No. 142

established a new fair value-based accounting model for the valuation of goodwill and indefinite-lived intangible assets recorded in connection with business

combinations. Pursuant to the provisions of SFAS No. 142, goodwill and indefinite-lived intangible assets are measured for impairment by applying a fair

value-based test at least annually and are not amortized.

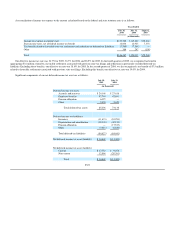

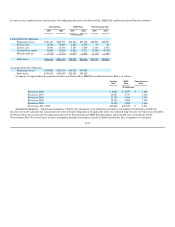

In connection with the adoption of the provisions of SFAS No. 142, we engaged third-party appraisal experts to assist with the determination of the fair

value of our goodwill and intangible assets. Fair value was determined using a discounted cash flow methodology. For each of our operating segments, a

summary of the carrying values of our intangible assets is as follows:

SFAS No. 142 Adjustments

Sale of

Chef's

Catalog

in 2005

At

August 4,

2002

At

Adoption

During

2003

During

2004

At

July 30,

2005

(in thousands)

Direct Marketing

Goodwill $ 23,747 $ — $ — $ — $ (8,875) $14,872

Indefinite-lived tradenames 60,732 (24,066) (813) (3,853) (8,300) 23,700

Other

Indefinite-lived tradenames 32,945 — — — — 32,945

$117,424 $(24,066) $ (813) $(3,853) $(17,175) $71,517

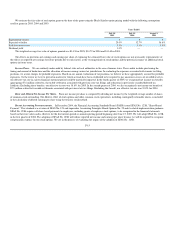

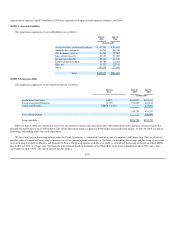

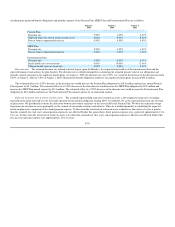

The $24.1 million writedown in the carrying value of the indefinite-lived intangible assets of our Direct Marketing segment required upon adoption of

SFAS No. 142 is reflected as a change in accounting principle ($14.8 million, net of taxes) in the accompanying consolidated statement of earnings for 2003.

The additional writedowns of $0.8 million in 2003 (included in selling, general and

F-19