Neiman Marcus 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing levels, redemption rates

and costs of awards to be chosen by our customers. Our customers redeem a substantial portion of the points earned in connection with our loyalty programs

for gift cards. At the time the qualifying sales giving rise to the loyalty program points are made, we defer the portion of the revenues on the qualifying sales

transactions equal to the estimate of the retail value of the gift cards to be issued upon conversion of the points to gift cards. We record the deferral of

revenues related to gift card awards under our loyalty programs as a reduction of revenues. In addition, we charge the cost of all other awards under our

loyalty programs to cost of goods sold.

Stock-Based Compensation. We account for stock-based compensation awards to employees in accordance with Accounting Principles Board Opinion

No. 25, "Accounting for Stock Issued to Employees," and related interpretations. We recognize compensation cost for the intrinsic value of stock-based

awards in an amount equal to the difference between the exercise price of the award and the fair value of our stock at the date of grant. Accordingly, we

recognize no compensation expense for stock options since all options granted have an exercise price equal to the market value of our common stock on the

grant date. We recognize compensation expense for our restricted stock and purchase restricted stock awards.

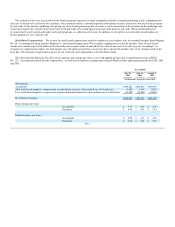

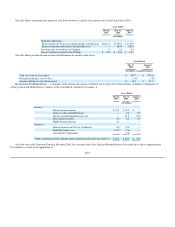

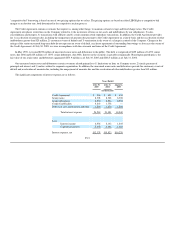

The following table illustrates the effect on net earnings and earnings per share as if we had applied the fair value recognition provisions of SFAS

No. 123, "Accounting for Stock-Based Compensation," to stock-based employee compensation using the Black-Scholes option-pricing model for 2005, 2004

and 2003:

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands, except per share data)

Net earnings:

As reported $248,824 $204,832 $109,303

Add: stock-based employee compensation recorded under intrinsic value method, net of related taxes 4,999 3,119 2,422

Less: stock-based employee compensation expense determined under fair value method, net of related taxes (13,302) (11,806) (10,269)

Pro forma net earnings $240,521 $196,145 $101,456

Basic earnings per share:

As reported $ 5.15 $ 4.27 $ 2.30

Pro forma $ 4.98 $ 4.09 $ 2.14

Diluted earnings per share:

As reported $ 5.02 $ 4.19 $ 2.29

Pro forma $ 4.86 $ 4.01 $ 2.12

F-14