Neiman Marcus 2004 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

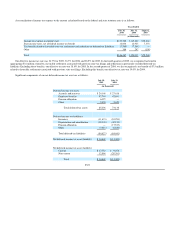

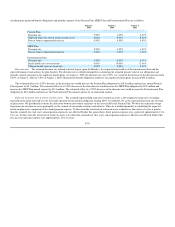

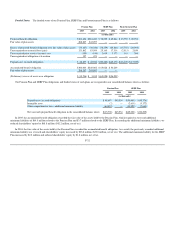

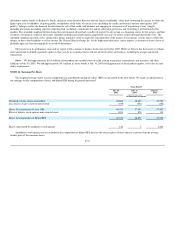

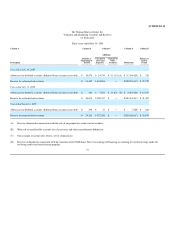

Future minimum rental commitments, excluding renewal options, under capital leases and non-cancelable operating leases are as follows: 2006—

$44.1 million; 2007—$44.2 million; 2008—$44.3 million; 2009—$44.4 million; 2010—$42.3 million; all years thereafter—$555.1 million.

Common area maintenance costs were $12.6 million for 2005, $11.9 million for 2004 and $12.5 million for 2003.

Investments in Brand Development Companies. Our investments in and relationships with our Brand Development Companies are governed by

operating agreements that provide for an orderly transition process in the event any investor wishes to sell its interest, or purchase another investor's interest.

Among other things, these operating agreements contain currently exercisable put option provisions entitling each minority investor to put their interest to us,

and currently exercisable call option provisions entitling us to purchase each minority investor's interest, at a purchase price mutually agreed to by the parties.

The purchase price will be determined, in the case of the Gurwitch interests, by one or more nationally recognized investment banking firms and, in the case

of the Kate Spade interests, by the parties or, in the event the parties are unable to agree on a mutually acceptable price, by a mutually acceptable nationally

recognized investment banking firm, subject to certain conditions. We may elect, in certain circumstances, to defer the consummation of a put option for a

period of six months by cooperating with the other investors in seeking either a sale of the Brand Development Company to a third party or a public offering

of the Brand Development Company's securities. If a sale to a third party or public offering of the Brand Development Company's securities is not

consummated within six months after the exercise of the put option (which period may be automatically extended for an additional two months if a

registration statement for the Brand Development Company is filed with the Securities and Exchange Commission), we are obligated to consummate the put

option. Under the terms of the Kate Spade operating agreement, such consummation shall occur within thirty days after the determination of the valuation

with respect to the exercise of the put option.

Recently, we have been in extensive discussions with the minority investors of Kate Spade LLC regarding certain strategic alternatives, including the

possible sale of such company. However, while such discussions are ongoing, no assurance can be given that they will ultimately lead to any transaction.

Litigation. We are currently involved in various legal actions and proceedings that arose in the ordinary course of business. We believe that any

liability arising as a result of these actions and proceedings will not have a material adverse effect on our financial position, results of operations or cash

flows.

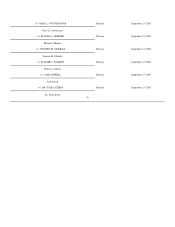

On May 4, 2005, a purported class action complaint, NECA-IBEW Pension Fund (The Decatur Plan) v. The Neiman Marcus Group, Inc. et al. (CA

No. 3-05 CV-0898B), was filed by a putative stockholder in federal court in the Northern District of Texas against The Neiman Marcus Group, Inc. and its

directors challenging the proposed merger. An amended complaint was filed on July 25, 2005. The amended complaint alleges a cause of action for breach of

fiduciary duty against us and our directors, claiming, among other things, that the defendants are endeavoring to complete the sale of The Neiman Marcus

Group Inc. and its assets at a grossly inadequate and unfair price and pursuant to an unfair process that fails to maximize shareholder value. In addition, the

amended complaint alleges that the directors are not independent and breached their fiduciary duties in connection with the approval of the merger by, among

other things, tailoring the transaction to serve the interests of the

F-34