Neiman Marcus 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

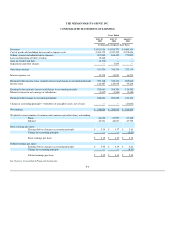

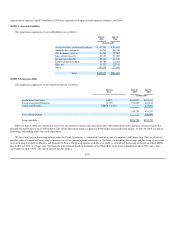

We estimate the fair value of each option grant on the date of the grant using the Black-Scholes option pricing model with the following assumptions

used for grants in 2005, 2004 and 2003:

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

Expected life (years) 5 5 5

Expected volatility 25.0% 32.7% 36.6%

Risk-free interest rate 3.3% 3.1% 3.0%

Dividend yield 1.0% — —

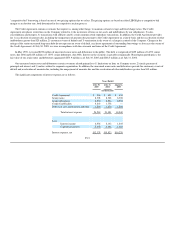

The weighted-average fair value of options granted was $14.38 in 2005, $14.79 in 2004 and $11.40 in 2003.

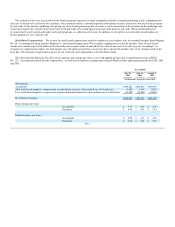

The effects on pro forma net earnings and earnings per share of expensing the estimated fair value of stock options are not necessarily representative of

the effects on reported net earnings for future periods due to such factors as the vesting periods of stock options and the potential issuance of additional stock

options in future years.

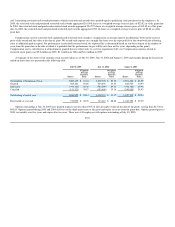

Income Taxes. We are routinely under audit by federal, state or local authorities in the area of income taxes. These audits include questioning the

timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating the exposure associated with various tax filing

positions, we accrue charges for probable exposures. Based on our annual evaluations of tax positions, we believe we have appropriately accrued for probable

exposures. To the extent we were to prevail in matters for which accruals have been established or be required to pay amounts in excess of recorded reserves,

our effective tax rate in a given financial statement period could be materially impacted. In the fourth quarter of 2005, we recognized net income tax benefits

aggregating $7.6 million related to a favorable settlement associated with previous state tax filings and reductions in previously recorded deferred tax

liabilities. Excluding these benefits, our effective tax rate was 38.6% for 2005. In the second quarter of 2004, we also recognized a net income tax benefit of

$7.5 million related to favorable settlements associated with previous state tax filings. Excluding this benefit, our effective tax rate was 39.0% for 2004.

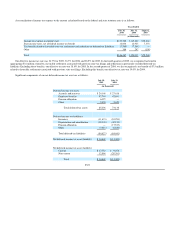

Basic and Diluted Net Income Per Share. Basic net income per share is computed by dividing net income by the weighted average number of shares

of common stock outstanding. The dilutive effect of stock options and other common stock equivalents, including contingently returnable shares, is included

in the calculation of diluted earnings per share using the treasury stock method.

Recent Accounting Pronouncements. In December 2004, the Financial Accounting Standards Board (FASB) issued SFAS No. 123R, "Share-Based

Payment." This standard is a revision of SFAS No. 123 and supersedes Accounting Principles Board Opinion No. 25 and its related implementation guidance.

SFAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements

based on their fair values and is effective for the first interim period or annual reporting period beginning after June 15, 2005. We will adopt SFAS No. 123R

in the first quarter of 2006. The adoption of SFAS No. 123R will reduce reported net income and earnings per share because we will be required to recognize

compensation expense for our stock options. We are in the process of evaluating the impact of the adoption of SFAS No. 123R.

F-15