Neiman Marcus 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recipient was allowed to allocate the choice award amount entirely to one alternative, or to a combination of two or three alternatives. If MRSUs were

chosen, the choice award recipient is required to purchase a number of shares of Class A Common Stock (the "Matched Common Stock") at 100% of

the fair market value on the date of grant and hold such shares for a period of three years from the date of the award (the "Vesting Date"). On the

Vesting Date, if the recipient is still employed by us or one of our subsidiaries, and the Matched Common Stock had not been otherwise disposed of, he

or she will receive one share of Class A Common Stock equal to the number of shares of Matched Common Stock. The MRSUs do not carry voting

rights. If cash dividends are paid on the Common Stock, outstanding MRSUs will be increased by a fractional unit ("Dividend Equivalents") having a

numerator equal to the amount per share of the cash dividend and a denominator equal to the closing price of a share of Class A Common Stock on the

New York Stock Exchange on the date a cash dividend is paid. If restricted stock units were chosen, the choice award recipient will receive a

contractual right to receive one share of Class A Common Stock equal to the number of restricted stock units subject to the same retention period as the

MRSUs. Restricted stock units carry no voting rights and accrue Dividend Equivalents in the same manner as MRSUs. All awards of MRSUs and

restricted stock units were made pursuant to the 1997 Plan. On October 29, 2004, the Named Executive Officers chose the following amounts pursuant

to their choice award dollar value: Burton M. Tanksy, 29,590 shares of MRSUs and 14,795 shares of restricted stock units; Karen W. Katz, 23,080

shares of MRSUs; James E. Skinner, 8,655 shares of MRSUs and 4,328 shares of restricted stock units; Brendan L. Hoffman, 865 shares of MRSUs and

866 shares of restricted stock units; and James J. Gold, 8,655 shares of MRSUs and 4,328 shares of restricted stock units.

As of the end of fiscal year 2005, the aggregate number of shares of restricted stock held by the Named Executive Officers, and the dollar value of such

shares, less consideration paid for shares of purchased restricted stock and purchased restricted stock units, based on the closing market price of our

Class A Common Stock on July 29, 2005 of $98.50, was: Mr. Tansky—113,535 ($10,172,820); Ms. Katz—76,980 ($6,736,752); Mr. Skinner—42,031

($3,639,315); Mr. Hoffman—11,921 ($1,091,663); and Mr. Gold—24,283 ($2,242,213).

The amounts reported include the cost to us of (a) matching contributions under our Key Employee Deferred Compensation Plan ("Matching

Contributions"), (b) group life insurance premiums, and (c) financial counseling. For fiscal year 2005, such amounts for each of the Named Executive

Officers were, respectively, as follows: Mr. Tansky—$63,639, $10,932, and $29,350; Ms. Katz—$40,582, $1,688, and $1,020; Mr. Skinner—$26,762,

$2,326, and $3,000. The amount for Mr. Hoffman includes $21,322 for Matching Contributions and $897 for group life insurance premiums. The

amount for Mr. Gold includes $1,050 for group life insurance premiums, $3,000 for financial counseling, and $182,085 for relocation expenses.

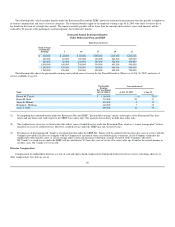

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants(1)

Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term ($)(3)

Number of

Securities

Underlying

Options

Granted

(#)

Percent of

Total Options

Granted to

Employees in

Fiscal Year(2)

Exercise

or Base

Price

($/Share)

Name

Expiration

Date 5% 10%

Burton M. Tansky 0 — — — 0 0

Karen M. Katz 0 — — — 0 0

James E. Skinner 0 — — — 0 0

Brendan L. Hoffman 31,042 5.4 60.83 10/29/2010 642,197 1,456,927

James J. Gold 0 — — — 0 0

Options granted during the 2005 fiscal year are nonqualified stock options to purchase shares of our Class A Common Stock, become fully exercisable

three years from the date of grant, and expire six years from the date of grant. All nonqualified stock options were granted pursuant to the 1997 Plan,

include tax withholding rights, and were granted at the fair market value based on the closing price of our Class A Common Stock on the date of grant.

54

(7)

(1)