Neiman Marcus 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

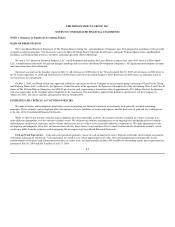

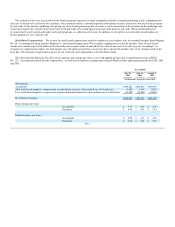

Buying and Occupancy Costs. Our buying costs consist primarily of salaries and expenses incurred by our merchandising and buying operations.

Occupancy costs primarily include rent, depreciation, property taxes and operating costs of our retail, distribution and support facilities.

Selling, General and Administrative Expenses. Selling, general and administrative expenses are comprised principally of the costs related to employee

compensation and benefits in the selling and administrative support areas, preopening expenses, advertising and catalog costs, insurance expense and income

and expenses related to our proprietary credit card portfolio.

We receive allowances from certain merchandise vendors in conjunction with compensation programs for employees who sell the vendors' merchandise.

These allowances are netted against the related compensation expense that we incur. Amounts received from vendors related to compensation programs were

$53.2 million in 2005, $46.3 million in 2004 and $41.1 million in 2003.

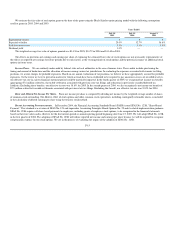

Preopening Expenses. Preopening expenses primarily consist of payroll and related media costs incurred in connection with new and replacement

store openings and are expensed when incurred. In 2005, we incurred preopening expenses of $1.4 million in connection with the scheduled opening of the

San Antonio store in September 2005 and two clearance centers opened in 2005. We opened no new stores in 2004 and had no preopening expenses in 2004.

Preopening expenses were $8.0 million for 2003.

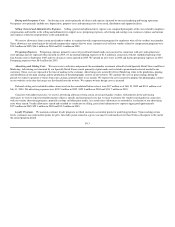

Advertising and Catalog Costs. We incur costs to advertise and promote the merchandise assortment offered by both Specialty Retail Stores and Direct

Marketing. Advertising costs incurred by our Specialty Retail Stores consist primarily of print media costs related to promotional materials mailed to our

customers. These costs are expensed at the time of mailing to the customer. Advertising costs incurred by Direct Marketing relate to the production, printing

and distribution of our print catalogs and the production of the photographic content on our websites. We amortize the costs of print catalogs during the

periods we expect to generate revenues from such catalogs, generally three to six months. We expense the costs incurred to produce the photographic content

on our websites at the time the images are first loaded onto the website. We expense website design costs as incurred.

Deferred catalog costs included in other current assets in the consolidated balance sheets were $8.7 million as of July 30, 2005 and $10.3 million as of

July 31, 2004. Net advertising expenses were $120.5 million in 2005, $125.0 million in 2004 and $113.7 million in 2003.

Consistent with industry practice, we receive advertising allowances from certain of our merchandise vendors. Substantially all the advertising

allowances we receive represent reimbursements of direct, specific and incremental costs that we incur to promote the vendor's merchandise in connection

with our various advertising programs, primarily catalogs and other print media. As a result, these allowances are recorded as a reduction of our advertising

costs when earned. Vendor allowances earned and recorded as a reduction to selling, general and administrative expenses aggregated approximately

$57.5 million in 2005, $55.3 million in 2004 and $53.2 million in 2003.

Loyalty Programs. We maintain customer loyalty programs in which customers accumulate points for qualifying purchases. Upon reaching certain

levels, customers may redeem their points for gifts. Generally, points earned in a given year must be redeemed no later than 90 days subsequent to the end of

the annual program period.

F-13