Neiman Marcus 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

"competitive bid" borrowing is based on one of two pricing options that we select. The pricing options are based on either LIBOR plus a competitive bid

margin or an absolute rate, both determined in the competitive auction process.

The Credit Agreement contains covenants that require us, among other things, to maintain certain leverage and fixed charge ratios. The Credit

Agreement also places restrictions on the Company related to 1) the incurrence of liens on our assets and indebtedness by our subsidiaries, 2) sales,

consolidations and mergers, 3) transactions with affiliates and 4) certain common stock repurchase transactions. In addition, the Credit Agreement provides

for 1) acceleration of amounts due, including the nonpayment of amounts due pursuant to the Credit Agreement on a timely basis and the acceleration of other

indebtedness greater than $25 million, 2) customary events of default and 3) termination in the event of a change in control of the Company. Changes in the

ratings of the senior unsecured long-term debt do not represent an event of default, accelerate repayment of outstanding borrowings or alter any other terms of

the Credit Agreement. At July 30, 2005, we were in compliance with the covenants and terms of the Credit Agreement.

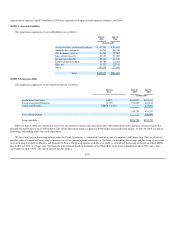

In May 1998, we issued $250 million of unsecured senior notes and debentures to the public. This debt is comprised of $125 million of 6.65% senior

notes, due 2008 and $125 million of 7.125% senior debentures, due 2028. Interest on the securities is payable semiannually. Based upon quoted prices, the

fair value of our senior notes and debentures aggregated $273.9 million as of July 30, 2005 and $268.3 million as of July 31, 2004.

Our unsecured senior notes and debentures contain covenants related primarily to 1) limitations on liens on Company assets, 2) timely payment of

principal and interest and 3) matters related to corporate organization. In addition, the unsecured senior notes and debentures provide for customary events of

default and acceleration of amounts due, including the nonpayment of amounts due and the acceleration of other indebtedness greater than $15 million.

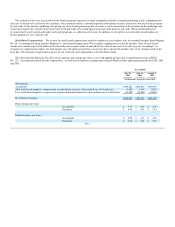

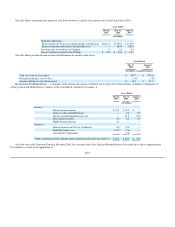

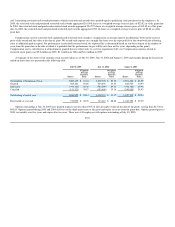

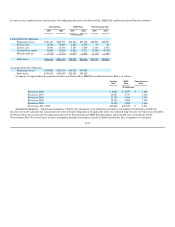

The significant components of interest expense are as follows:

Years Ended

July 30,

2005

July 31,

2004

August 2,

2003

(in thousands)

Credit Agreement $ 560 $ 422 $ 430

Senior notes 8,308 8,308 8,308

Senior debentures 8,904 8,904 8,904

Credit Card Facility 5,243 1,778 —

Debt issue cost amortization and other 1,269 1,679 1,298

Total interest expense 24,284 21,091 18,940

Less:

Interest income 6,556 2,132 1,245

Capitalized interest 5,350 3,036 1,425

Interest expense, net $12,378 $15,923 $16,270

F-21