Neiman Marcus 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

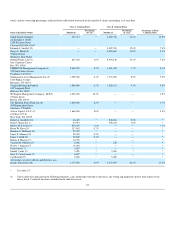

the Smith Family Holders. See Note 2. Mr. Smith disclaims beneficial ownership of 316,812 shares of Class B common stock held by various family

trusts.

Includes 55,500 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. All of the

shares owned by Mr. Knez are included in the shares owned by the Smith Family Holders. See Note 2. Mr. Knez disclaims beneficial ownership of

353,351 shares of Class B common stock held by his spouse and by various family trusts and foundations.

Includes 402,200 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. Also

includes 29,590 shares of restricted Class A common stock over which Mr. Tansky has voting but not dispositive power and 113,790 shares of

restricted stock units over which Mr. Tansky has no voting and no dispositive power.

Includes 106,500 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. Also

includes 76,980 shares of restricted Class A common stock over which Ms. Katz has voting but not dispositive power, 23,212 shares of restricted stock

units over which Ms. Katz has no voting and no dispositive power, and 1,089 shares of Class A common stock allocated to Ms. Katz under the

Company's employee savings plan as to which Ms. Katz shares voting power with the trustee.

Includes 13,700 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. Also

includes 11,055 shares of restricted Class A common stock over which Mr. Hoffman has voting but not dispositive power and 1,739 shares of

restricted stock units over which Mr. Hoffman has no voting and no dispositive power.

Includes 48,000 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. Also

includes 37,703 shares of restricted Class A common stock over which Mr. Skinner has voting but not dispositive power and 13,056 shares of

restricted stock units over which Mr. Skinner has no voting and no dispositive power.

Includes 6,400 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005. Also includes

19,955 shares of restricted Class A common stock over which Mr. Gold has voting but not dispositive power and 13,056 shares of restricted stock units

over which Mr. Gold has no voting and no dispositive power.

Dr. Horner, Dr. Stern, Mr. O'Reilly, Dr. Salmon, Mr. Countryman, Mr. Cook and Mr. Sewell each hold, respectively, 14,429; 5,501; 5,099; 5,099;

5,512; 2,871; and 2,291 common stock-based units which are included in the table. These directors do not have voting or dispositive power with

respect to these common stock-based units.

Includes (i) 719,100 shares of Class A common stock that are subject to outstanding options exercisable within 60 days of September 2, 2005,

(ii) 187,033 shares of restricted Class A common stock over which individuals in the group have voting but not dispositive power, (iii) 222,372 shares

of restricted stock units and stock-based units referred to in Note 18 above over which individuals in the group have no voting and no dispositive

power, and (iv) 1,089 shares of Class A common stock allocated to an individual in the group under the Company's employee savings plan as to which

such individual shares voting power with the trustee.

Changes in Control

On August 16, 2005, our shareholders approved the Agreement and Plan of Merger, dated as of May 1, 2005, among us, Newton Acquisition, Inc. and

Newton Acquisition Merger Sub, Inc. which will result in a change of control. The merger transaction is expected to become final no later than

November 2005.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Currently, and during fiscal year 2005, Burton M. Tansky, our President and Chief Executive Officer, has an outstanding loan balance under the

Company's former Key Executive Stock Purchase Loan Plan (the "Loan Plan") in the amount of $369,253. The loan was used to exercise stock options and

discharge tax liabilities, as provided in the Loan Plan. The loan bears interest at the annual rate of

67

(11)

(12)

(13)

(14)

(15)

(16)

(17)

(18)